JP 225 analysis: a correction after the decline is coming to an end

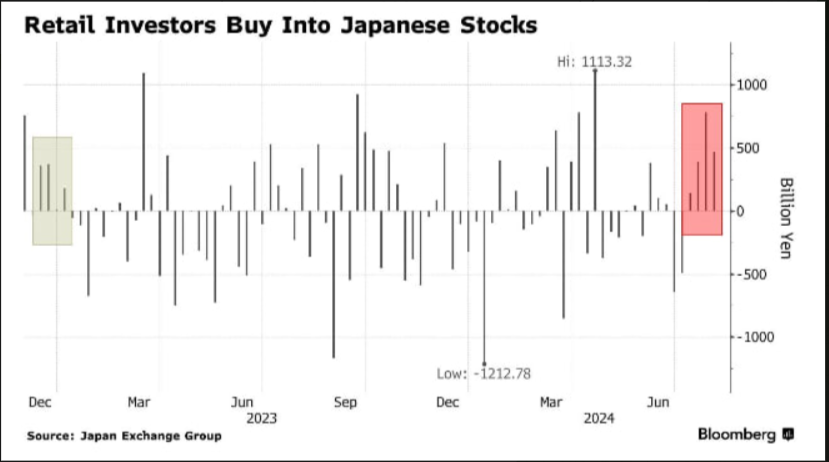

The JP 225 stock index has been rising as part of a correction since the middle of last week after a sharp decline on 5 August. Since retail investors have a significant share in Japanese stocks, the JP 225 index forecast is negative.

JP 225 forecast: key trading points

- Recent data: Japan’s producer price index increased by 3% in July compared to the same period last year

- Economic indicators: accelerating inflation may influence the Bank of Japan’s decision on interest rates, which it has pledged not to raise until the end of the year

- Market impact: a key rate hike boosts yield on Japanese government bonds and drives global demand for Japanese assets

- Resistance: 39,280.0, Support: 30,370.0

- JP 225 price forecast: 29,340.0

Fundamental analysis

Japan’s producer price index rose by 3.0% in July from the same period last year, accelerating from a 2.9% increase in June. Japan’s main indices surged on Tuesday as the country resumed stock trading after the holidays amid general growth in the Asia-Pacific markets.

Source: https://x.com/Barchart/status/1821717063221624959

Growth momentum was largely driven by the country’s technology and financial sectors: Rakuten Group and Trend Micro stocks. Additionally, retail investors have been purchasing Japanese stocks for four consecutive weeks, marking the longest series of purchases since January 2023.

According to JPMorgan Chase & Co. data, three-quarters of the global carry trade has already been unwound, with a recent sell-off erasing the gains accumulated this year. Returns on carry trade baskets in the BIG-10 countries, emerging markets, and globally tracked by the bank have decreased by about 10% since May, as noted by quantitative strategists Antonin Delair, Meera Chandan, and Kunj Padh in their note to clients. These changes have completely wiped out the year-to-date returns and significantly reduced profits since the end of 2022. For this reason, the JP 225 forecast for next week is negative.

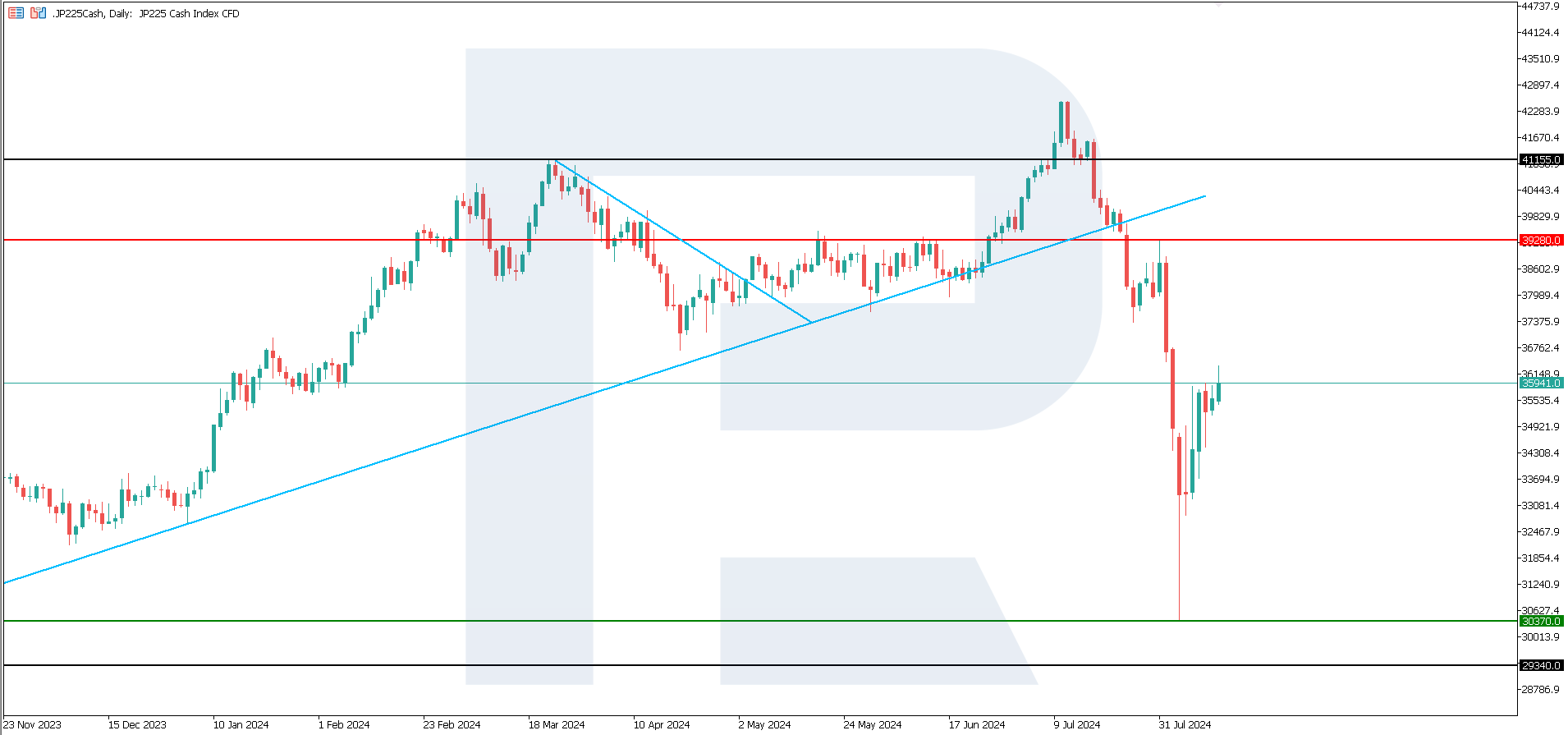

JP 225 technical analysis

The JP 225 stock index has risen nearly 20% from its lows. However, this rebound is not enough to overturn the prevailing downward momentum, with prices still reflecting a bearish trend. They must secure above the 37,280.0 mark for a reversal signal to emerge. Otherwise, the JP 225 price forecast will remain negative.

Key levels for the JP 225 analysis:

- Resistance level: 39,280.0 – if the price breaks above this level, it could target 41,155.0

- Support level: 30,370.0 – if the price breaks below the support level, it could aim for 29,340.0

Summary

The JP 225 stock index has been rising as part of a correction since the middle of last week after a sharp decline on 5 August. However, demand is primarily driven by retail investors and needs to increase to form a steady trend. Prices remain in a bearish phase globally, with a potential decline target at 29,340.0.

Los pronósticos de los mercados financieros son la opinión personal de sus autores. El análisis actual no es una guía de trading. RoboForex no se hace responsable de los resultados que puedan ocurrir por utilizar las recomendaciones presentadas.