US 30 analysis: a new all-time high will unlikely be the last one this year

The US 30 index reached 45,000.0 points as part of the current uptrend. Find out more in our US 30 price forecast and analysis for next week, 2-6 December 2024.

US 30 forecast: key trading points

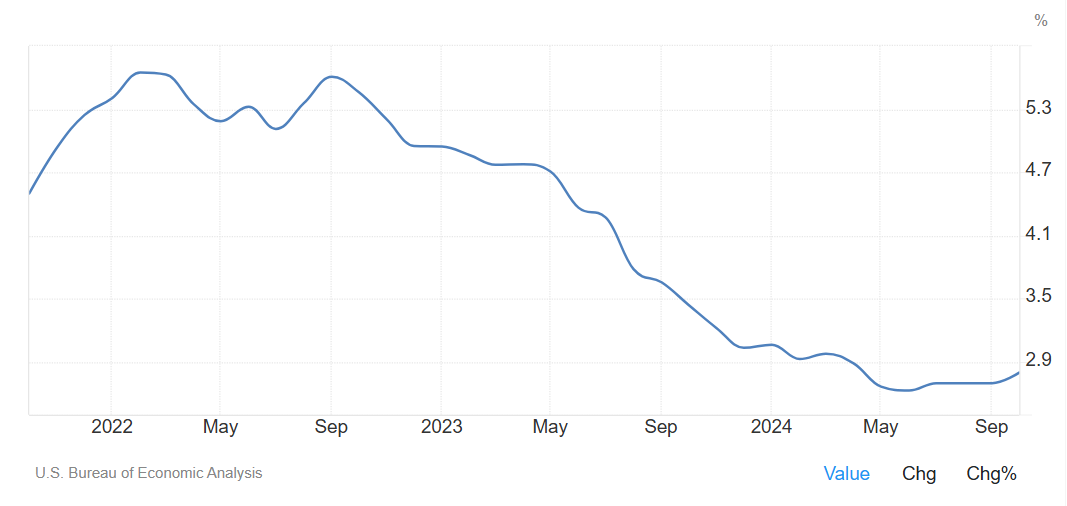

- Recent data: the PCE price index was 2.8% year-on-year

- Economic indicators: this inflation gauge excludes food and energy prices

- Market impact: the PCE price index is a crucial metric for the US Federal Reserve in determining future interest rates

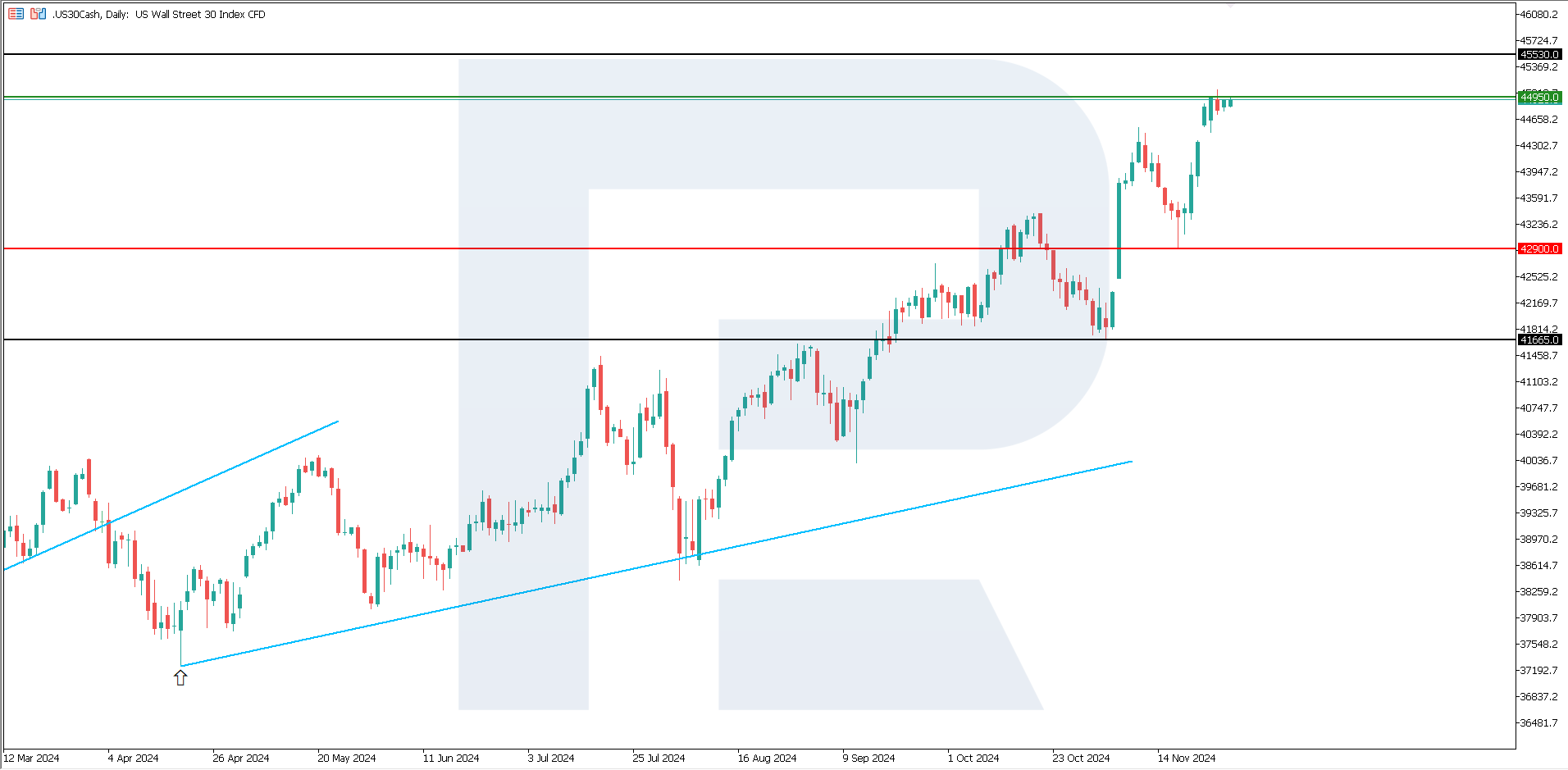

- Resistance: 44,950.0, Support: 42,900.0

- US 30 price forecast: 45,530.0

Fundamental analysis

The PCE price index was 2.8% year-on-year. The indicator met market analysts’ expectations, but its increase from 2.7% indicates the strengthening of fundamental inflation factors. The Federal Reserve pays special attention to the core PCE price index, as it more accurately reflects long-term trends by excluding volatile categories.

Source: https://tradingeconomics.com/united-states/core-pce-price-index-annual-change

The inflation report indicates steady growth, aligned with expectations. However, a slight acceleration in annual readings may raise concerns about future Fed actions. If the Federal Reserve remains confident in controlling inflation and maintains stable rates, this will support stocks. However, if the inflation rise persists, market sentiment may deteriorate.

With core PCE inflation at 2.8%, consumer prices appear to have bottomed out. History shows that a second inflationary wave is highly likely in such cases. What makes this situation unique is the Federal Reserve’s limited capacity to combat the second wave, as further rate hikes may exacerbate the already strained US national debt situation. The US 30 index forecast is cautiously optimistic.

US 30 technical analysis

The US 30 stock index remains on an upward trajectory, hitting an all-time high of 45,000.0 points. According to the US 30 technical analysis, the index retains its growth potential. Therefore, it could achieve new highs repeatedly before the end of the year. Any decline is likely to be a short-term correction within a global uptrend.

The following scenarios are considered for the US 30 price forecast:

- Pessimistic US 30 forecast: a breakout below the 42,900.0 support level could push the index down to 41,665.0

- Optimistic US 30 forecast: a breakout above the 44,950.0 resistance level could propel the price to 45,530.0

Summary

The current 2.8% (y/y) PCE price index indicates a likelihood of a second inflationary wave. The US Federal Reserve is unlikely to address it effectively as interest rate hikes would exacerbate the national debt situation, potentially causing tensions between the US political leadership and the Federal Reserve.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.