World indices overview: news from US 30, US 500, US Tech, JP 225, and DE 40 for 11 February 2025

Strong US labour market data and President Donald Trump’s promises to introduce new tariffs are leading to uncertainty among investors. Find out more in our analysis and forecast for global indices for 11 February 2025.

US indices forecast: US 30, US 500, US Tech

- Recent data: US unemployment rate was 4.0%

- Market impact: along with inflation, labour market indicators are key for the Federal Reserve in determining monetary policy parameters

Fundamental analysis

The current Nonfarm Payrolls reading of 143 thousand indicates that the US economy is creating fewer new jobs than analysts expected. This may dampen investor optimism as weak labour market data is sometimes considered a signal of lower economic growth.

The unemployment rate was 4.0%, above expectations of 4.1%. This may signal that the labour market is still rather tight (meaning that labour supply is relatively small compared to demand), with unemployment at a low level. A moderately weak NFP and low unemployment provide a mixed signal. Investors will wait for the Federal Reserve’s further comments and other macroeconomic data.

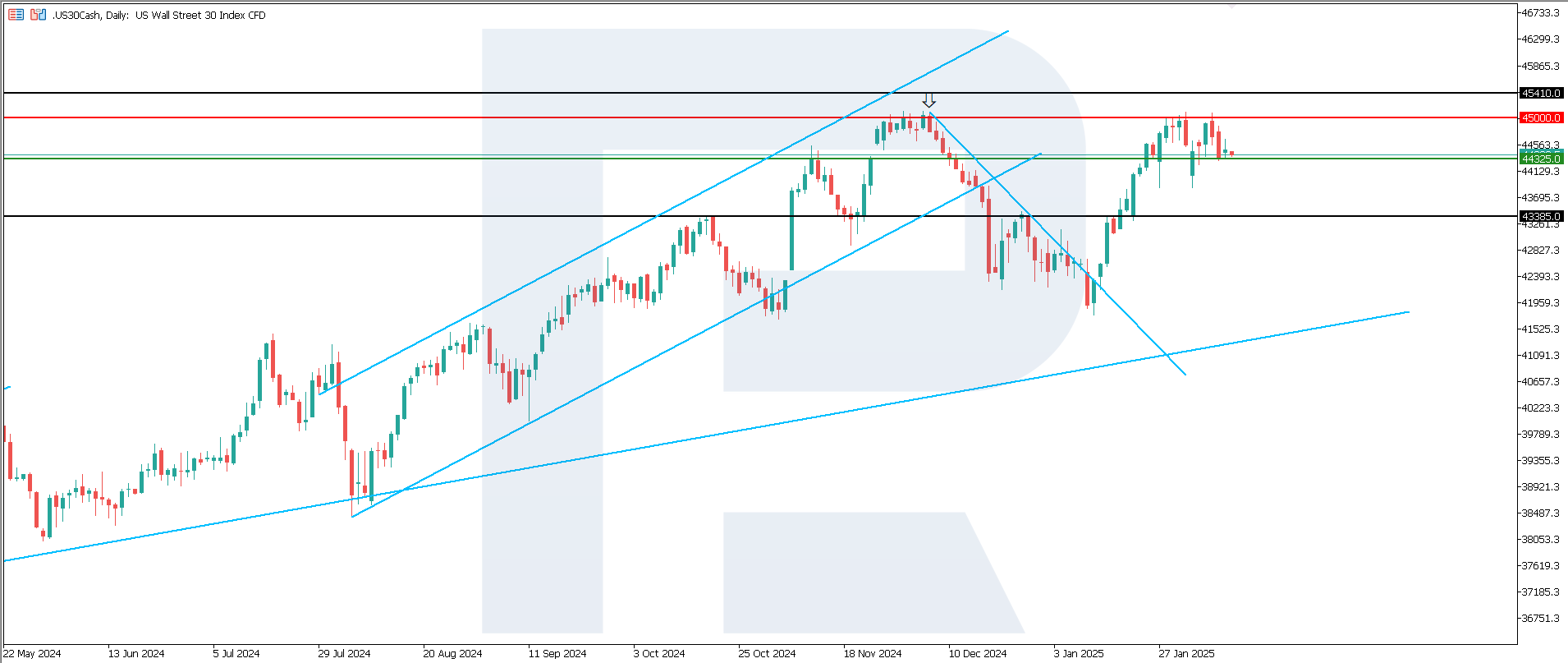

US 30 technical analysis

The US 30 stock index failed to breach the 45,000.0 resistance level. The uptrend persists, while the growth momentum is weakening. According to the US 30 technical analysis, a corrective downtrend will begin after a breakout below the 44,325.0 support level.

The following scenarios are considered for the US 30 price forecast:

- Pessimistic US 30 forecast: a breakout below the 44,325.0 support level could send the index down to 43,385.0

- Optimistic US 30 forecast: a breakout above the 45,000.0 resistance level could drive the index to 45,410.0

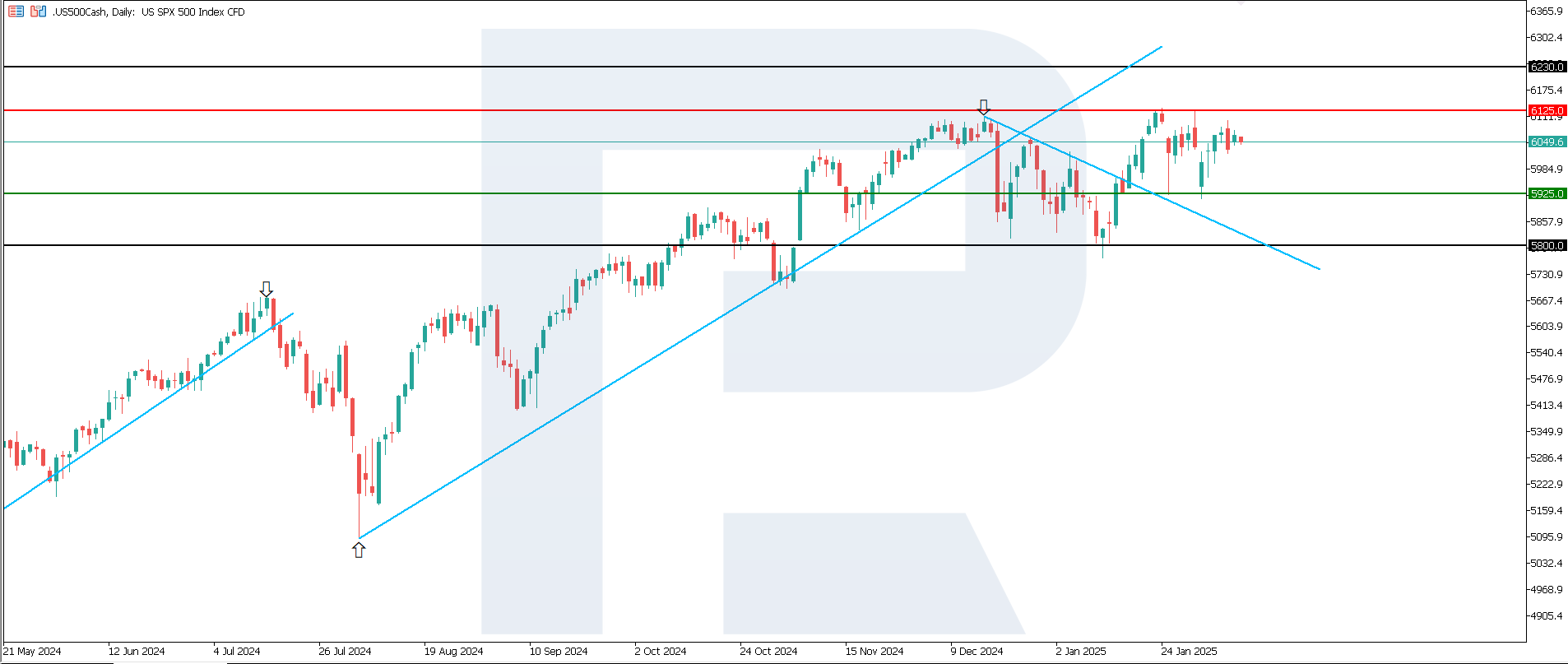

US 500 technical analysis

The US 500 stock index has been trading within the previously formed channel since late January. There are no prerequisites for a trend to form as the current range suits most market players. According to the US 500 technical analysis, the quotes will remain in the sideways range in the medium term.

The following scenarios are considered for the US 500 price forecast:

- Pessimistic US 500 forecast: a breakout below the 5,925.0 support level could push the index down to 5,800.0

- Optimistic US 500 forecast: a breakout above the 6,125.0 resistance level could propel the index to 6,230.0

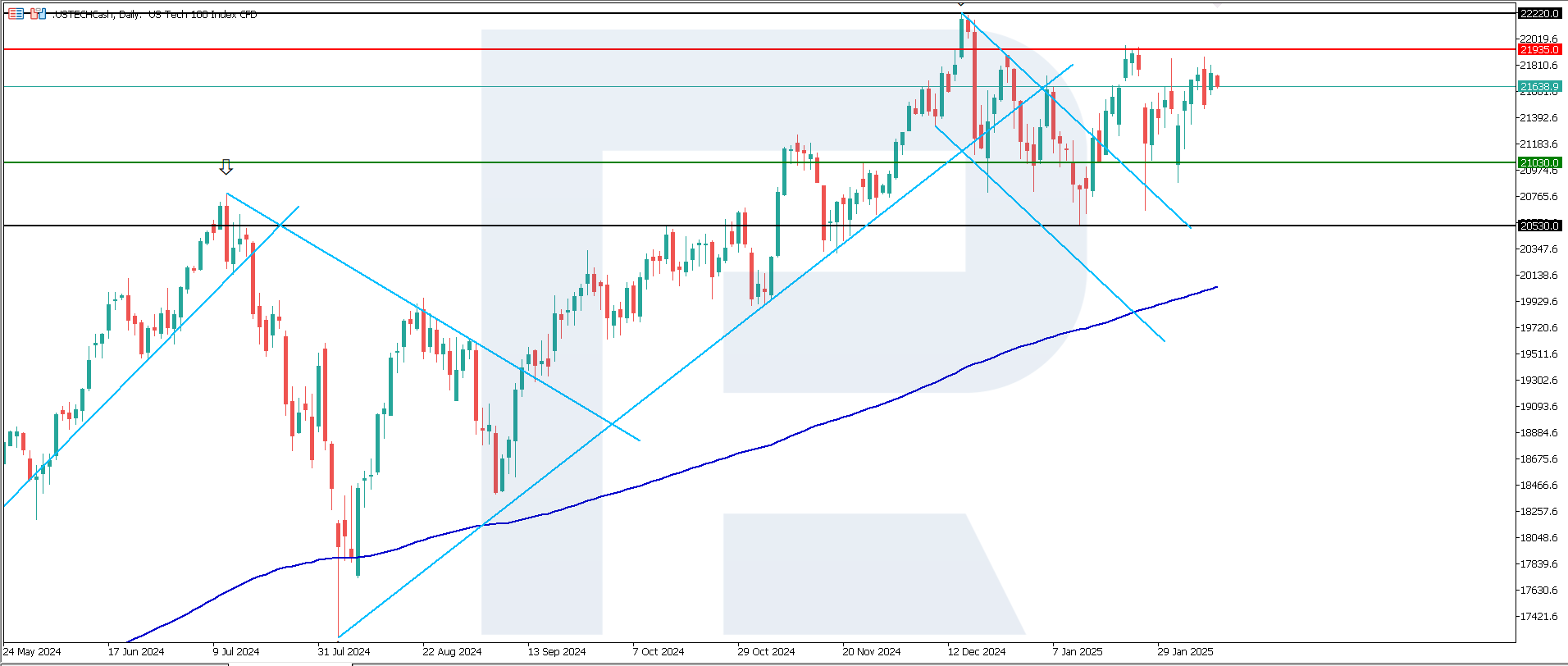

US Tech technical analysis

The US Tech quotes are rising to the upper boundary of the sideways channel. The price will unlikely break above the 21,935.0 resistance level. According to the US Tech technical analysis, the index may trade sideways for quite a long time. Large investors are probably buying up assets in small volumes, expecting their further growth.

The following scenarios are considered for the US Tech price forecast:

- Pessimistic US Tech forecast: a breakout below the 21,030.0 support level could send the index down to 20,530.0

- Optimistic US Tech forecast: a breakout above the 21,935.0 resistance level could push the index up to 22,220.0

Asian index forecast: JP 225

- Recent data: Japan’s services PMI came in at 53 points in January

- Market impact: the increase in this indicator points to an improvement in Japan’s services sector and growing demand for related services

Fundamental analysis

Japan’s services PMI rose from 50.9 to 53 points, indicating an improvement in the Japanese services sector and growing demand for related services. The increase in the PMI in Japan, one of the world’s leading economies, indicates that business activity is stabilising or improving. Positive dynamics in Asia often create more favourable investor sentiment globally.

The increase in the services PMI is a factor that supports Japanese stocks, especially in the short to medium term. Higher business activity in the services sector typically boosts investor confidence and drives growth in the Japanese stock market.

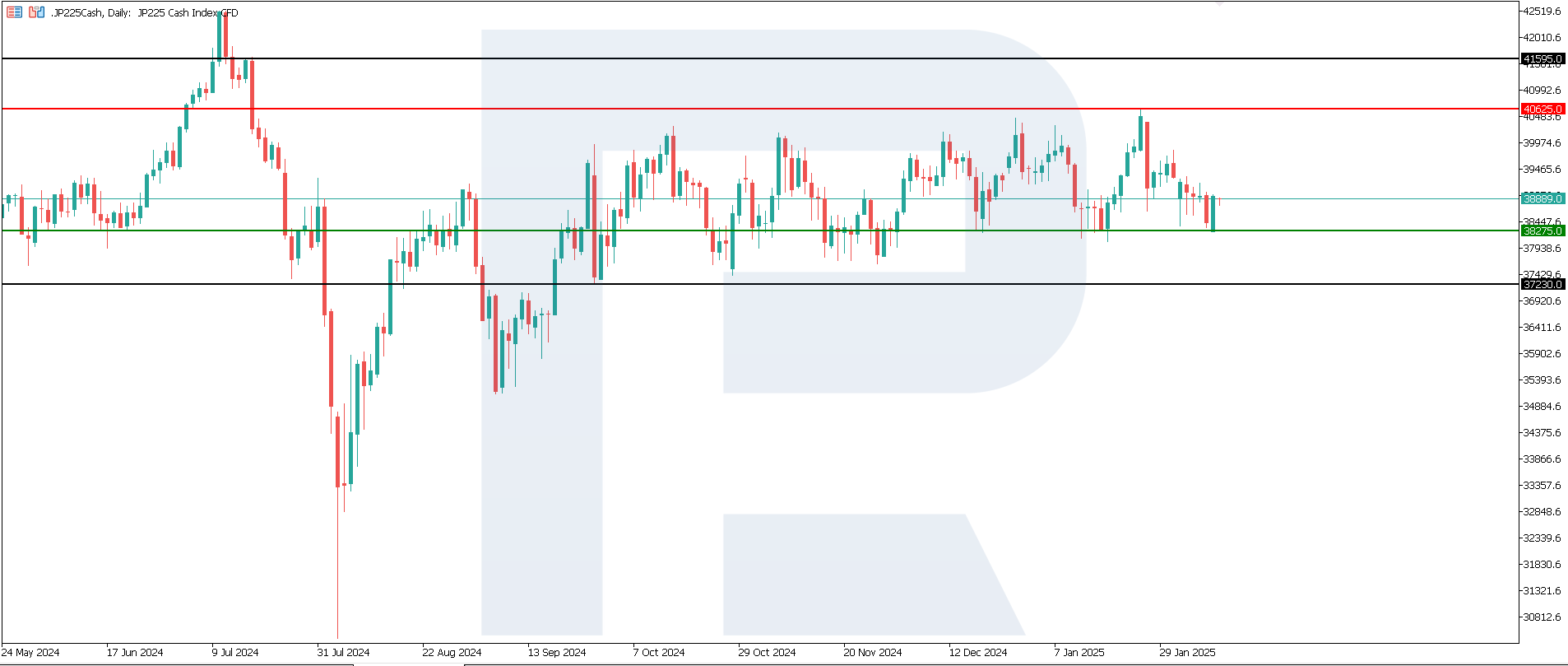

JP 225 technical analysis

The JP 225 stock index is rebounding from the lower boundary of the sideways channel at 38,275.0. The quotes will highly likely rise to its upper boundary at 40,625.0. According to the JP 225 technical analysis, there may be no trend in the long term.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 forecast: a breakout below the 38,275.0 support level could push the index down to 37,230.0

- Optimistic JP 225 forecast: a breakout above the 40,625.0 resistance level could propel the index to 41,595.0

European index forecast: DE 40

- Recent data: Germany’s industrial production figures fell to 3.1% year-on-year in December

- Market impact: stocks, especially cyclical sectors, may be under pressure

Fundamental analysis

A sharp decrease in industrial production is a bad signal for the future financial performance of companies. Weak macroeconomic data generally fuels expectations that the ECB could further lower the key rate.

A strong decline in Germany’s industrial production is a negative signal for the German stock market in the short term. Investors are concerned about an economic slowdown, which typically leads to a decline in stocks of industrial and cyclical companies. However, the possible easing of the ECB policy or an improved external environment may offset this negative development to some extent and bolster the German stock market.

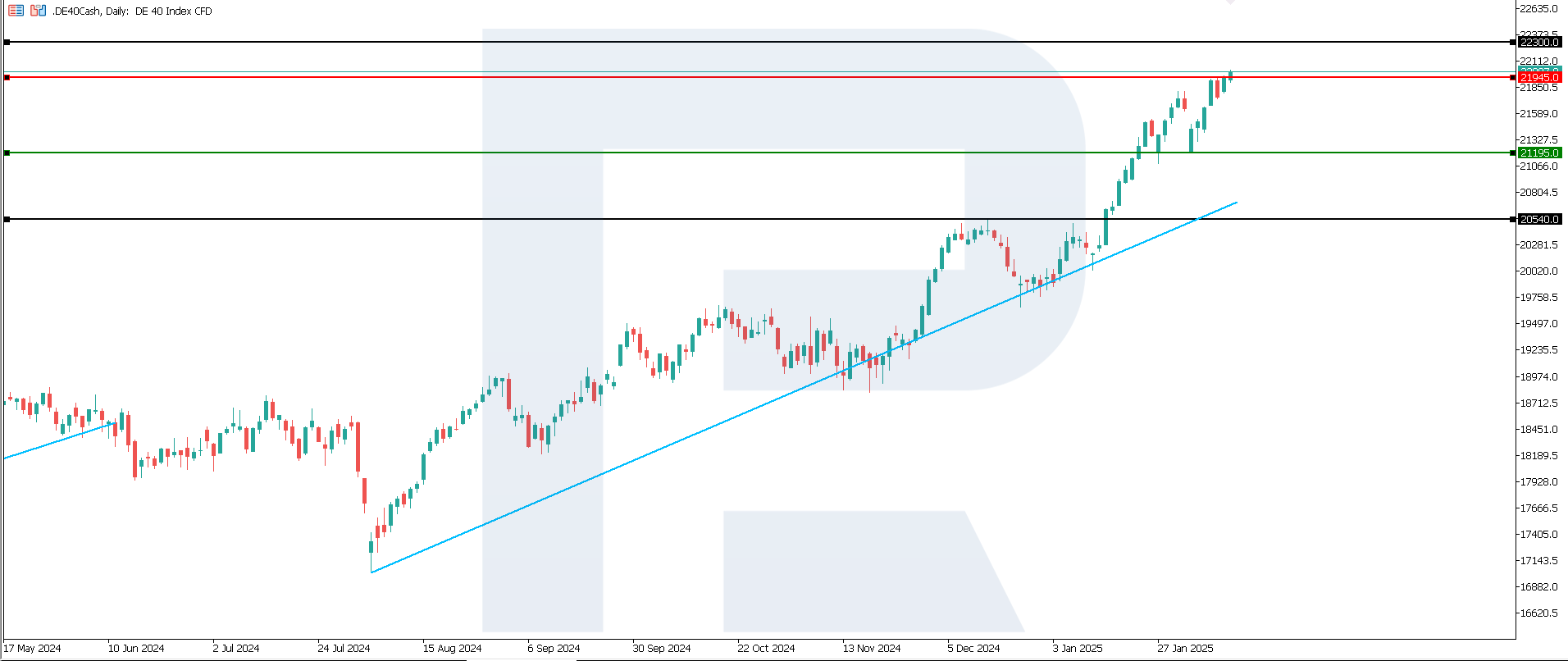

DE 40 technical analysis

The uptrend in the DE 40 stock index continues. However, it should be noted that growth rates are slowing, and the momentum is weakening. According to the DE 40 technical analysis, a downward correction is likely in the short term.

The following scenarios are considered for the DE 40 price forecast:

- Pessimistic DE 40 forecast: a breakout below the 21,195.0 support level could send the index down to 20,540.0

- Optimistic DE 40 forecast: a breakout above the 21,945.0 resistance level could drive the index to 22,300.0

Summary

The world’s leading indices are trading in sideways channels, with the American US 30 and German DE 40 as the only exceptions as they remain in the uptrend. However, a corrective decline in these two indices is looming ahead. The threat of new US trade tariffs and mixed labour market statistics add to uncertainty. Investors will await the Federal Reserve’s comments and US inflation data.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.