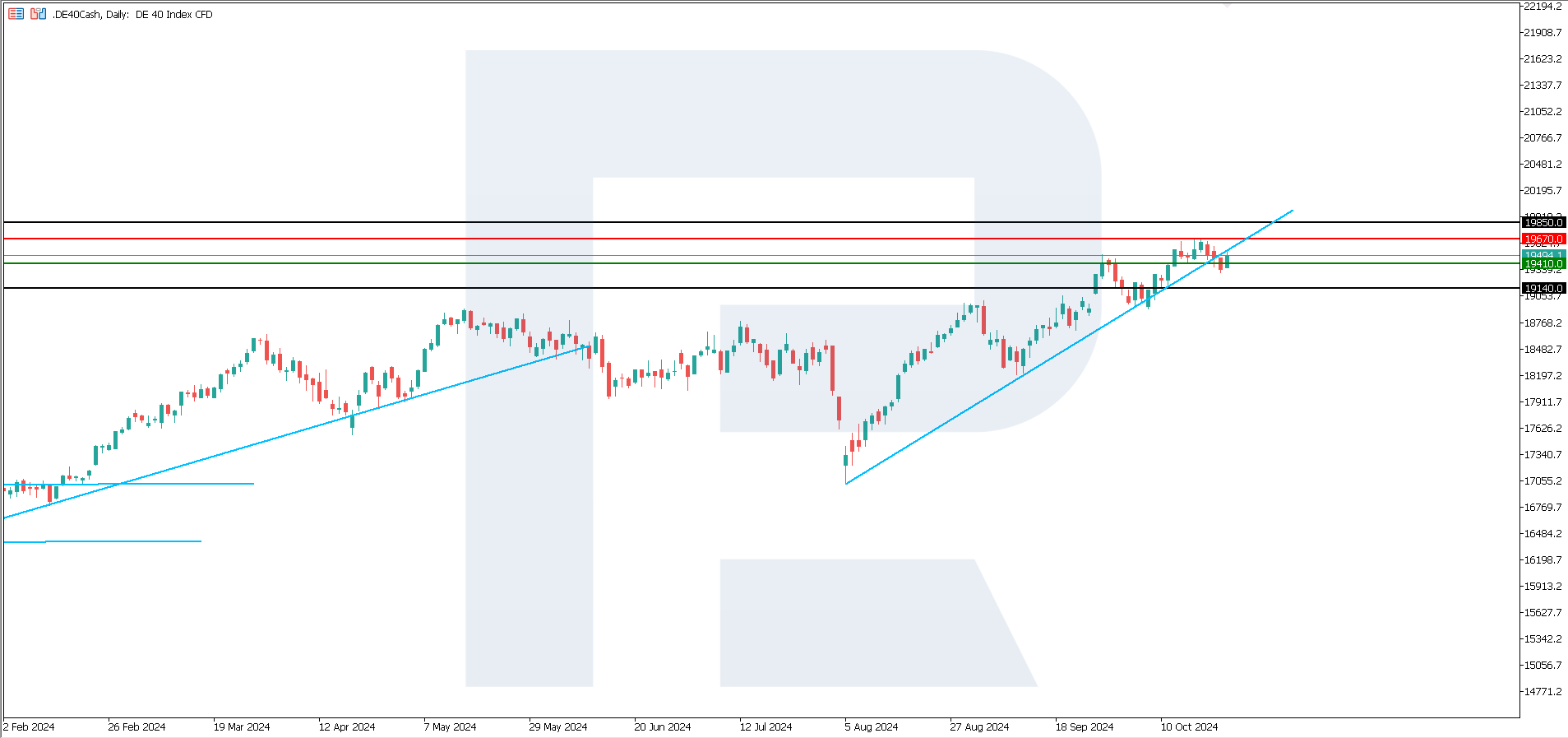

DE 40 analysis: a correction began after the price reached a new all-time high

The DE 40 stock index has entered a downtrend after reaching a new all-time high. The DE 40 forecast for next week is pessimistic.

DE 40 forecast: key trading points

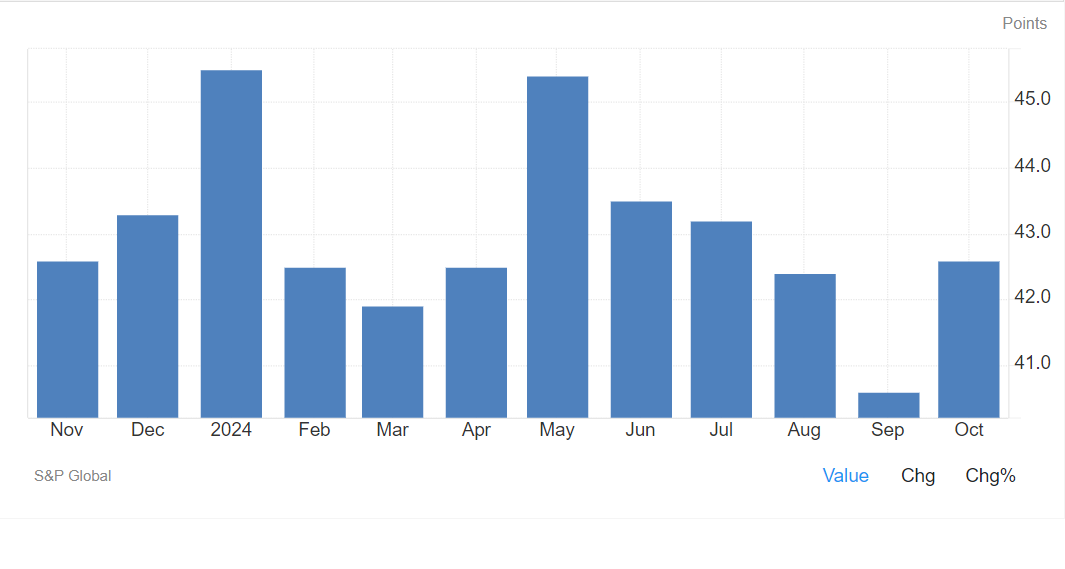

- Recent data: Germany’s preliminary manufacturing PMI for October was 42.6 points

- Economic indicators: the manufacturing PMI reflects changes in activity in the German manufacturing sector

- Market impact: economic uncertainty reflected in weak PMI may increase stock market volatility

- Resistance: 19,670.0, Support: 19,410.0

- DE 40 price forecast: 19,140.0

Fundamental analysis

The composite PMI (48.4) and manufacturing PMI (42.6) remain below 50.0 points, signalling decreased economic activity, although the rate of contraction has slowed compared to the previous period. The services PMI (51.4) indicates moderate growth in this sector.

Source: https://tradingeconomics.com/germany/manufacturing-pmi

The manufacturing PMI remains in contraction territory (42.6), which may negatively affect the stocks of manufacturing companies if investors interpret it as a sign of further economic challenges. The composite PMI data remaining below 50.0 suggests economic weakness. This could make investors more cautious and drive quotes lower, especially if further deterioration is anticipated.

At an open discussion of the Bundestag Finance Committee, Siemens’ Global Head of Tax, Christian Kaeser, said there was little reason to invest in Germany; therefore, Siemens’ recent investments were mostly made abroad. This highlights the scepticism large businesses have regarding the German economic outlook. The DE 40’s growth is driven mainly by the ECB’s dovish monetary policy. Therefore, the medium-term DE 40 index forecast is pessimistic.

DE 40 technical analysis

The DE 40 stock index was in a weak uptrend, but after hitting a new all-time high, it broke below the 19,410.0 support level and initiated a correction. A medium-term downtrend is highly likely to form. According to the DE 40 technical analysis, the nearest decline target could be 19,140.0.

The following scenarios are considered for the DE 40 price forecast:

- Pessimistic DE 40 forecast: if the price breaks below the 19,410.0 support level, the index could fall to 19,140.0

- Optimistic DE 40 forecast: a breakout above the 19,670.0 resistance level may propel the price up to 19,850.0

Summary

The manufacturing PMI is in contraction territory (42.6), which may negatively affect the stocks of manufacturing companies, especially if investors perceive it as a signal of further economic challenges. The medium-term downtrend is highly likely to form, with a potential nearest target for decline at 19,140.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.