DE 40 analysis: the index rises steadily, securing above 20,000.0

The DE 40 stock index is rapidly strengthening this week and has firmly established itself above the psychologically important 20,000.0 level. The DE 40 forecast for next week remains positive.

DE 40 forecast: key trading points

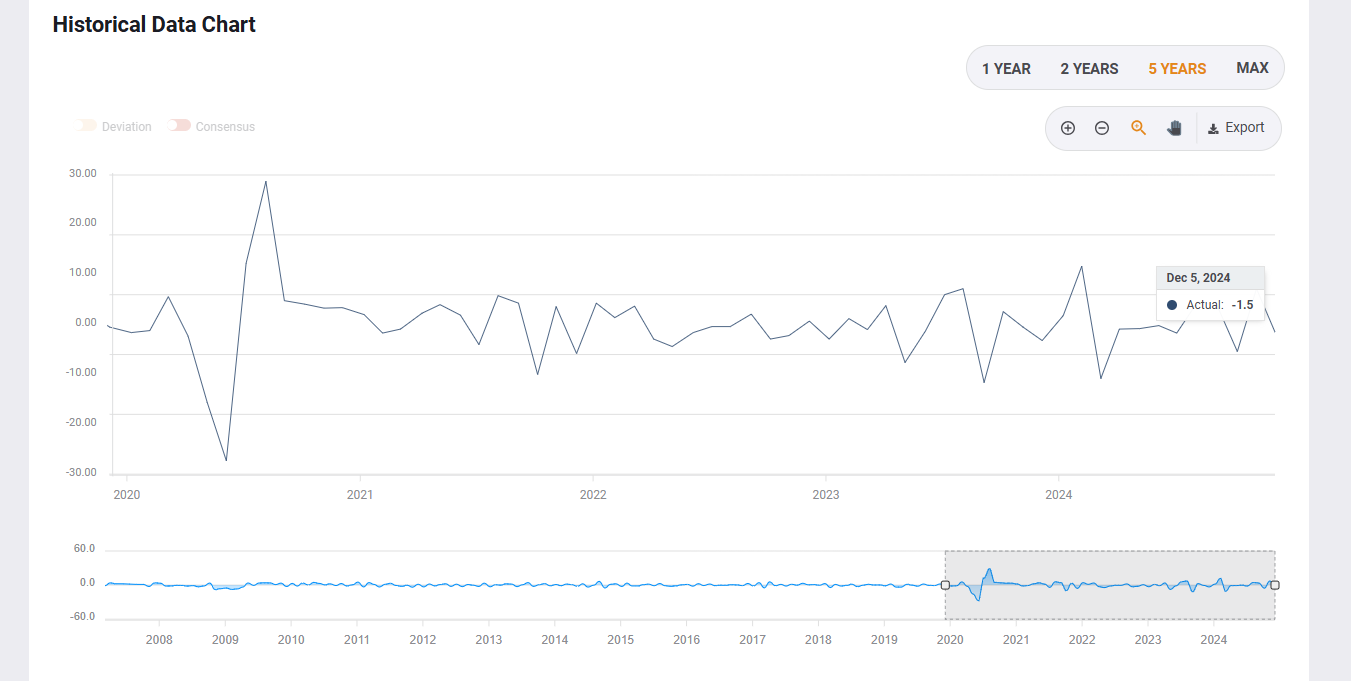

- Recent data: Germany’s factory orders decreased by 1.5% in October, outperforming projections of a 2.0% decline

- Economic indicators: factory orders measure deliveries, inventories, and new and unfulfilled production orders

- Market impact: an increase in this indicator positively affects the stock market, while a decrease has an adverse impact

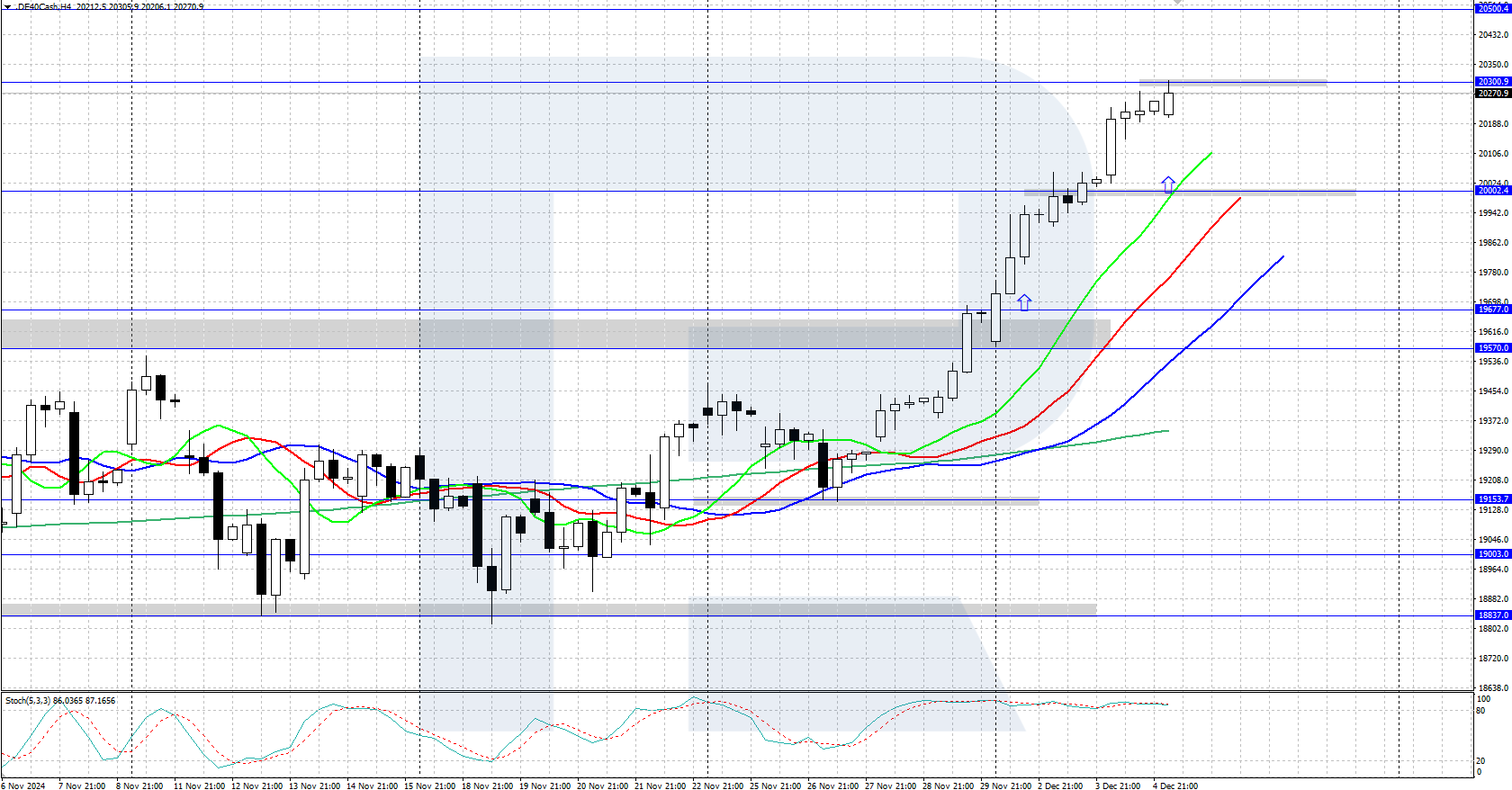

- Resistance: 20,300.0, Support: 20,000.0

- DE 40 price forecast: 20,500.0

Fundamental analysis

Germany’s factory orders decreased by 1.5% m/m in October, exceeding expectations for a 2.0% decline. Last month, the figure was revised upwards to 7.2%, marking the most significant increase since the start of the year.

European stock markets are optimistic this week, showing steady growth mirroring trends in the US markets. Concerns about political instability in France and the worsening of the military conflict in Ukraine appear to be easing, encouraging investors to invest in promising assets.

The DE 40 index closed the trading session above the psychologically important 20,000.0 level for the first time in history. It maintained its upward trajectory for five consecutive days, supported by strong upward momentum across global stock markets. On Wednesday, the biggest gainers were Zalando (8.17%), SAP (3.61%), and Daimler Truck Holding AG (3.30%).

DE 40 technical analysis

The DE 40 index is steadily rising this week, surpassing its all-time high of 19,677.0. A strong uptrend is underway, with prices firmly establishing above the psychologically important 20,000.0 level. Growth is expected to continue if the index remains above this threshold.

The following scenarios are considered for the DE 40 price forecast:

- Pessimistic DE 40 forecast: if the price secures below the 20,000.0 level, the index could correct towards 19,000.0

- Optimistic DE 40 forecast: if the price surpasses the 20,300.0 resistance level, it could continue its upward movement to 20,500.0

Summary

This week, the DE 40 stock index is rapidly strengthening, holding above the psychologically important 20,000.0 level. The trend remains upward, with growth likely to continue.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.