DE 40 analysis: the index rises moderately, finding support at 19,150.0

This week, the DE 40 stock index continues to appreciate, securing above the psychologically important 19,000.0 level. The DE 40 forecast for next week is neutral.

DE 40 forecast: key trading points

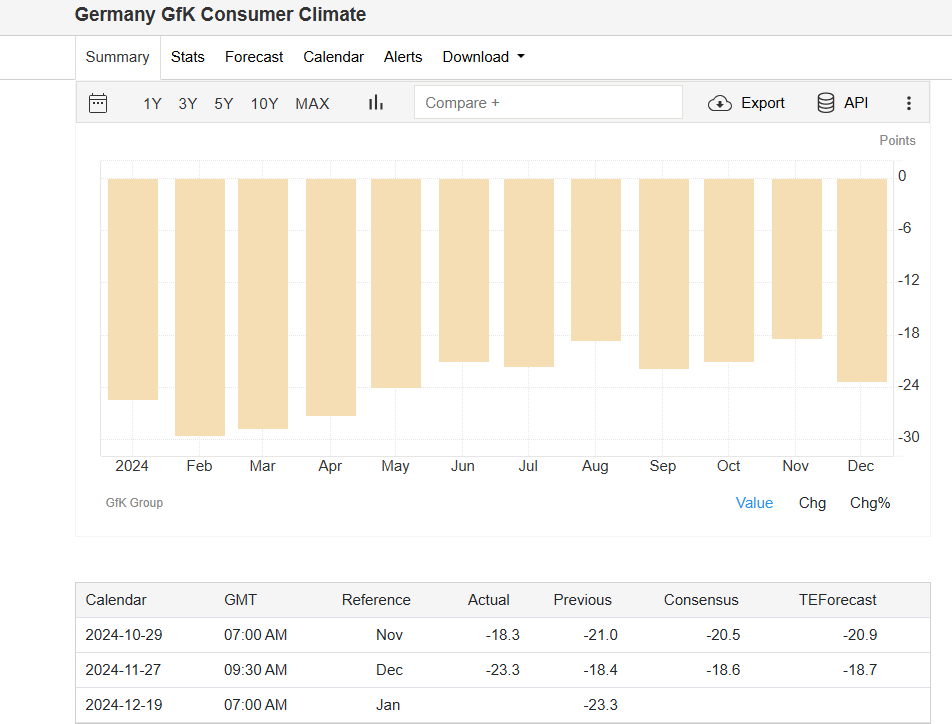

- Recent data: the GfK Consumer Climate Indicator for Germany fell to -23.3 points in December

- Economic indicators: the GfK Consumer Climate Indicator measures consumer confidence in the country

- Market impact: an increase in the indicator positively impacts the stock market, while a decrease has an adverse effect

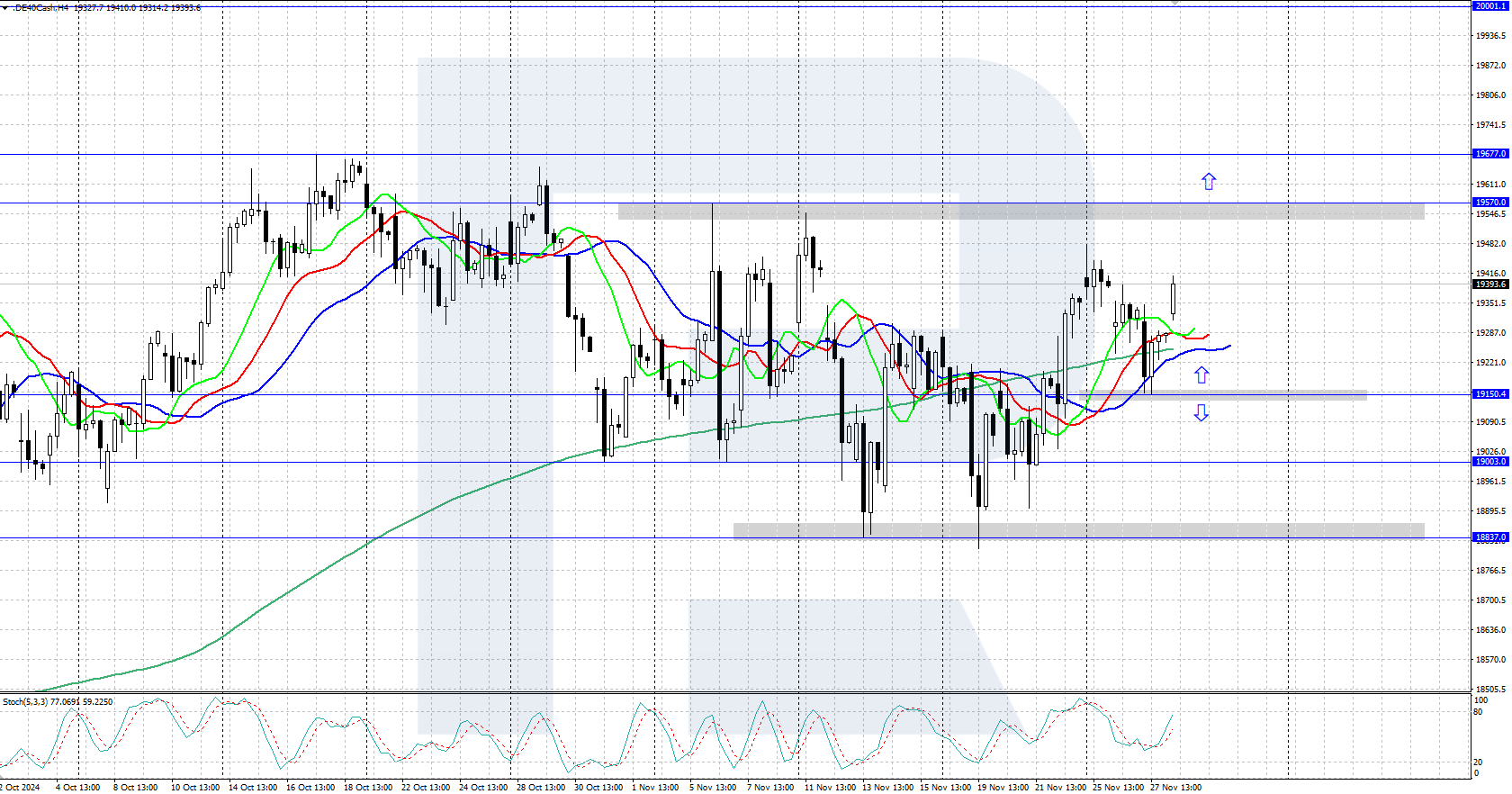

- Resistance: 19,570.0, Support: 19,150.0

- DE 40 price forecast: 19,500.0

Fundamental analysis

The GfK Consumer Climate Indicator for Germany fell to -23.3 points in December, hitting the lowest level since May 2024. Overall, current economic uncertainty, geopolitical risks, and lower income growth confidence keep Germany’s consumer sentiment at its lowest levels.

Source: https://tradingeconomics.com/germany/consumer-confidence

European stock markets remain under pressure due to a further escalation of hostilities between Russia and Ukraine. Investors are selling off risky assets due to concerns about the current conflict’s potential expansion, with the possible involvement of NATO countries.

Investors are also wary of mounting global trade tensions due to US President-elect Donald Trump’s new tariff policy. Trump has already announced a 10% additional tariff on all Chinese goods and a 25% tariff on imports from Canada and Mexico. Rising import duties from the US may also pressure Germany’s economy.

DE 40 technical analysis

The DE 40 index is gradually recovering after receiving support from buyers at 19,150.0. There is no clear trend now, with the index trading within a wide price range between 18,837.0 and 19,570.0. The direction of the price movement outside the range will determine the index’s further prospects.

The following scenarios are considered for the DE 40 price forecast:

- Pessimistic DE 40 forecast: if the price secures below the 19,150.0 level, the index could decline to 18,837.0

- Optimistic DE 40 forecast: if the price surpasses the 19,570.0 resistance level, it could reach a new high of 19,677.0, opening the potential for growth towards 20,000.0

Summary

The DE 40 stock index is trading within a broad sideways range, not supporting the growth of US stock indices yet. Investors are concerned that the current conflict between Russia and Ukraine may expand, potentially involving NATO countries.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.