USDJPY: yen under pressure, what will key indicators reveal?

Despite positive fundamental data from Japan, the USDJPY rate may continue to rise towards 152.00. Find more details in our analysis for 26 March 2025.

USDJPY forecast: key trading points

- Japan’s Leading Economic Index: previously at 108.3, currently at 108.3

- US durable goods orders: previously at 3.1%, currently at -1.1%

- USDJPY forecast for 26 March 2025: 152.00 and 149.70

Fundamental analysis

Japan’s Leading Economic Index estimates the overall economic climate, combining 12 indicators, including machinery orders and stock prices. A reading below 50.0 shows that most indicators are negative, while a reading above 50.0 suggests positive changes across most metrics.

Fundamental analysis for 26 March 2025 shows that the index held steady at 108.3. This high level may be one of the factors that support the yen against the US dollar in the future.

The US durable goods orders reflect changes in the volume of new orders for durable goods. High readings signal increased producer activity. These figures tend to be volatile and may be revised when the factory orders report is released about a week later.

The forecast for 26 March 2025 shows that the reading is expected to fall to -1.1%, pointing to a contraction in production for the previous period. Given that the previous reading was 3.1%, this could weigh negatively on the US dollar.

USDJPY technical analysis

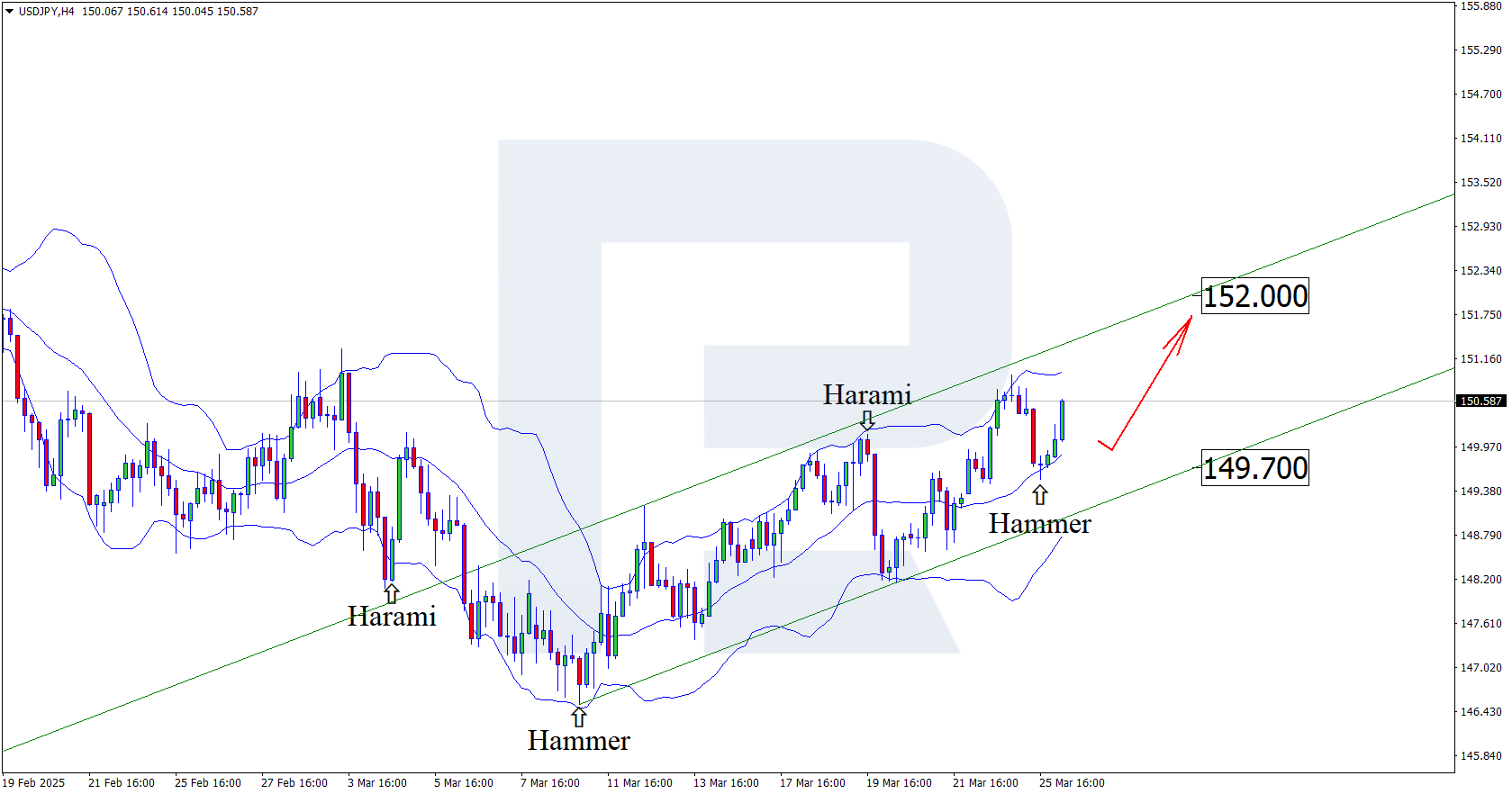

Having tested the middle Bollinger band, the USDJPY price has formed a Hammer reversal pattern on the H4 chart. At this stage, it is moving upwards following the pattern signal. Since the quotes have rebounded from the support level and remain within the ascending channel, they will likely climb to the resistance level.

The upside target is the 152.00 level. A breakout above this mark could pave the way for a stronger bullish trend.

However, today’s USDJPY forecast also considers an alternative scenario, where the price corrects towards 149.70 before rising.

Summary

The USDJPY forecast for today remains unfavourable for the yen as positive Japanese data fails to support it. The USDJPY technical analysis suggests further growth to the 152.00 resistance level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.