USDCAD: economic storm – what awaits USDCAD today

Mixed US fundamental data could trigger a rise in USDCAD quotes towards the 1.4400 resistance area. Discover more in our analysis for 24 March 2025.

USDCAD forecast: key trading points

- US services PMI: previously at 51.2, projected at 51.0

- US manufacturing PMI: previously at 51.9, projected at 52.7

- USDCAD forecast for 24 March 2025: 1.4400 and 1.4285

Fundamental analysis

The USDCAD forecast for today, 24 March 2025, takes into account several economic indicators that may affect the USDCAD rate.

The US services PMI is expected to fall to 51.0. Given that it has been declining over the past few months, investors do not have high hopes for the actual data. If the actual PMI is better than expected, it could help the USD strengthen against the Canadian dollar.

The US manufacturing PMI measures the activity of purchasing managers in the industrial sector. It reflects the state of the industrial sector and the dynamics of manufacturing processes in the country. Purchasing managers are the first to receive information about the performance of their companies, which makes PMI an important indicator for assessing the overall economic situation. Readings above 50.0 indicate an increase in production, while those below it point to a decline.

Fundamental analysis for 24 March 2025 suggests the US manufacturing PMI might rise to 52.7. The growth is not substantial, and it should also be noted that the figure remains above the 50.0 threshold.

USDCAD technical analysis

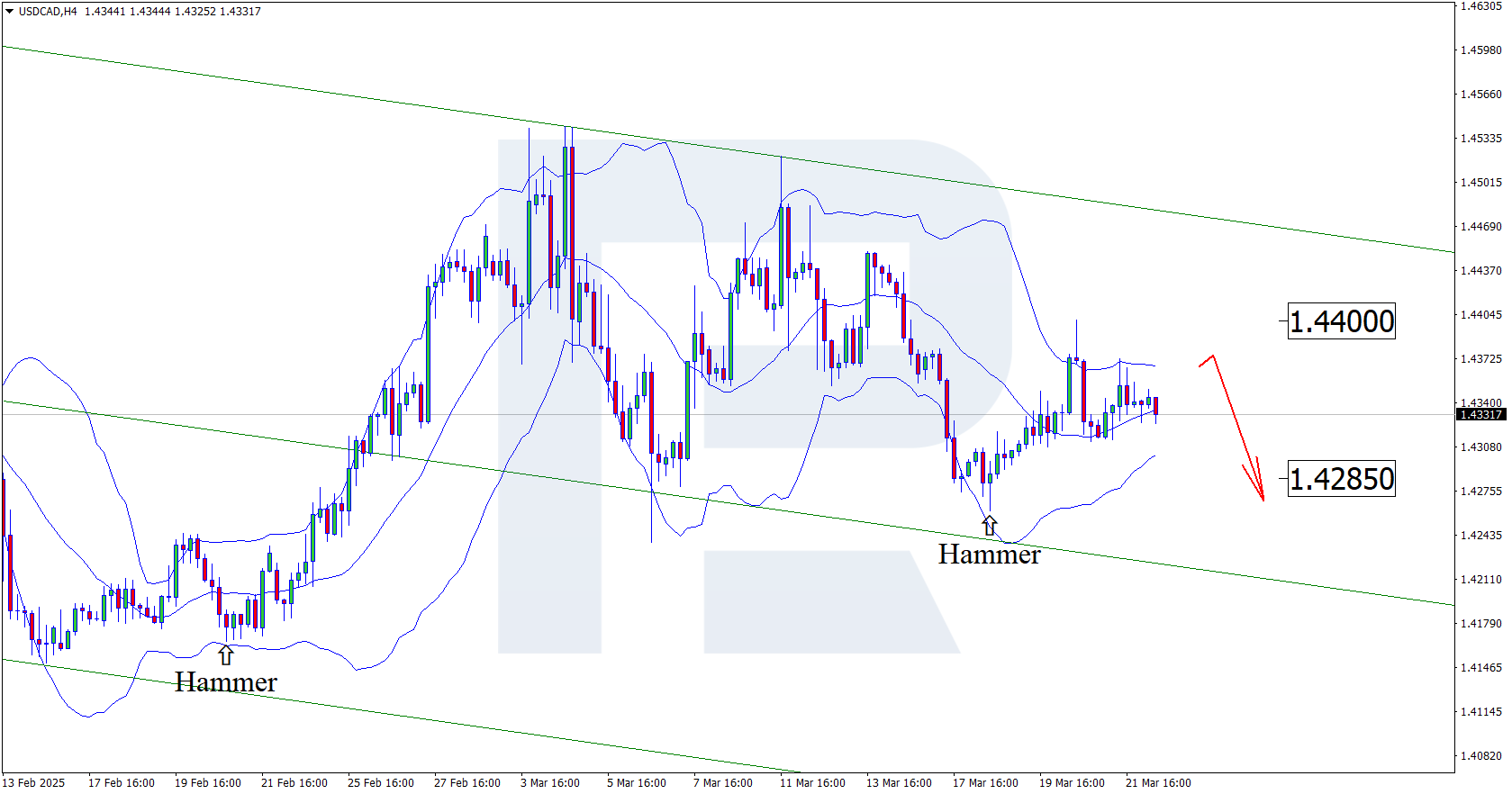

On the H4 chart, the USDCAD pair has formed a Hammer reversal pattern near the lower Bollinger band. At this stage, it continues its upward trajectory following the received signal. Since the pair still trades within a descending channel, a correction towards the nearest resistance at 1.4400 is possible. If the price bounces off this resistance level, the downtrend may resume.

However, the forecast for 24 March 2025 also considers another scenario where the price declines to 1.4285 and gains its downward momentum without testing the resistance level.

Summary

The USDCAD forecast hinges on upcoming US economic indicators. The expected decline in the services PMI to 51.0 may weaken the USD, while a rise in the manufacturing PMI to 52.7 would support it. At the same time, the USDCAD technical analysis suggests a possible correction towards the 1.4400 resistance level before a decline.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.