GBPUSD forecast: the pair forms a correction before growth

The change in the US CPI data may support a correction in the GBPUSD pair towards 1.2855. Discover more in our analysis for 12 March 2025.

GBPUSD forecast: key trading points

- The US Consumer Price Index (CPI): previously at 3.0%, projected at 2.9%

- The US core CPI: previously at 3.3%, projected at 3.2%

- GBPUSD forecast for 12 March 2025: 1.2855 and 1.3000

Fundamental analysis

The US Consumer Price Index (CPI) reflects changes in consumer prices of goods and services, helping assess changes in buying trends and economic stagnation. A higher-than-forecast reading typically has a positive effect on the USD. Weaker-than-expected data may push the GBPUSD rate higher.

The forecast for 12 March 2025 suggests that the CPI for February could decline from the previous reading of 3.0%, with expectations currently around 2.9%.

The US core CPI measures the dynamics of prices for goods and services from the consumer perspective. The calculation excludes the cost of energy and food due to seasonal fluctuations in these product categories.

Fundamental analysis for 12 March 2025 takes into account that the core CPI may fall to 3.2% from the previous reading of 3.3%. In this case, such a decrease could provide some support to the USD.

GBPUSD technical analysis

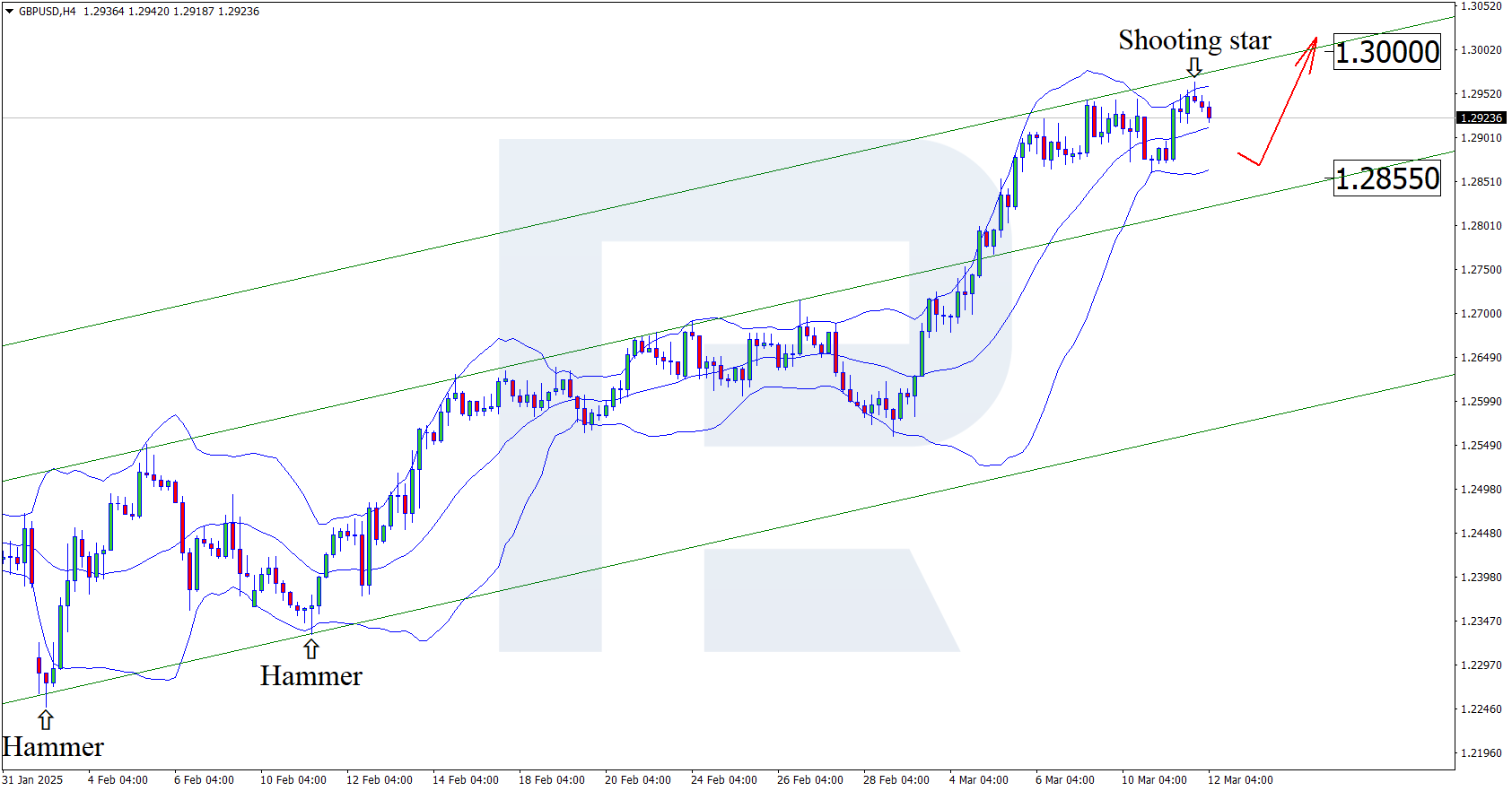

Having tested the upper Bollinger band, the GBPUSD price has formed a Shooting Star reversal pattern on the H4 chart. At this stage, it is developing a corrective wave following the received signal. Since the quotes remain within an ascending channel and given the US fundamental data, the correction could continue towards 1.2855. If quotes rebound from the support level, they could maintain their upward momentum.

The target for a pullback is the 1.2855 support level. A rebound from this level may open the potential for a more substantial upward wave.

The GBPUSD forecast also takes into account an alternative scenario, where the price rises to 1.3000 without testing the support level.

Summary

The GBPUSD forecast for today is based on the US fundamental data and, combined with the GBPUSD technical analysis, suggests a correction towards the 1.2855 support level before growth.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.