EURUSD halted its decline: market remains tense as risks mount

The EURUSD pair paused around 1.0819. The market continues to monitor the situation around US trade tariffs. Find more details in our analysis for 24 March 2025.

EURUSD forecast: key trading points

- The EURUSD pair has fallen for three consecutive trading sessions but has now paused

- The market is closely watching the US tariff issue: there is less and less time left before the retaliatory duties come into effect

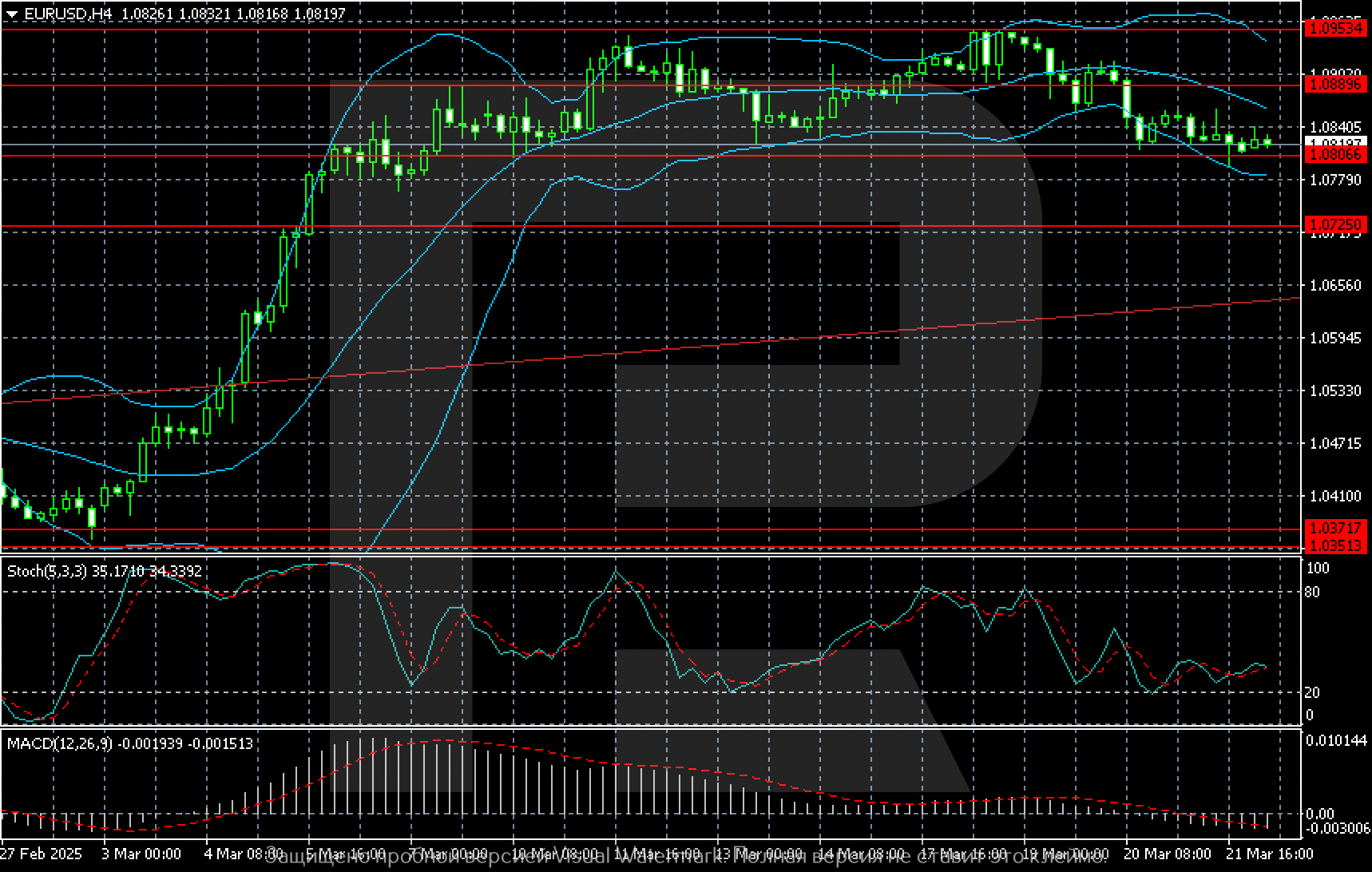

- EURUSD forecast for 24 March 2025: 1.0806 and 1.0725

Fundamental analysis

The EURUSD rate halted its decline near 1.0819.

Investors are tense at the start of the final week of March. They are watching the details of President Donald Trump's trade policy ahead of the 2 April deadline. This is the day when the US is set to introduce retaliatory tariffs against countries that have previously agreed to higher tariffs on US goods.

Last Friday, Trump noted that the tariff plan could be flexible. Over the weekend, capital markets analysed the developments and concluded that the tariffs might be narrow in scope, which would protect certain sectors of the economy.

Tariffs are still expected to put pressure on US economic growth. This scenario keeps the US dollar under strain, while local easing allows for corrections.

Last week, the US Federal Reserve left the interest rate unchanged but signalled two rate cuts during 2025.

The EURUSD forecast is neutral.

EURUSD technical analysis

On the H4 chart, a clear downtrend continues to unfold for EURUSD, with a new selling target at 1.0806. If the price consolidates below this level, the next downside target will be 1.0725.

Summary

The EURUSD pair has declined significantly, but the risks of further selling persist, with the 2 April deadline lying ahead. On that day, the US is expected to impose its tariffs on trading partners, which creates high market risks. The EURUSD forecast for today, 24 March 2025, does not rule out continued sales to the intermediate target of 1.0806 and then to 1.0725.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.