EURUSD forecast: the euro is poised to strengthen further

The growth of industrial production in the eurozone and the decline in the US PPI could lead to the completion of the correction, driving the EURUSD pair up to 1.0955. Discover more in our analysis for 13 March 2025.

EURUSD forecast: key trading points

- The eurozone’s industrial production: previously at -1.1%, projected at 0.5%

- US initial jobless claims: previously at 221 thousand, projected at 226 thousand

- US Producer Price Index (PPI): previously at 0.4%, projected at 0.3%

- EURUSD forecast for 13 March 2025: 1.0955 and 1.0850

Fundamental analysis

Fundamental analysis for 13 March 2025 takes into account that industrial production in the eurozone for the previous period may leave negative territory and reach 0.5%, which will be a positive factor for the euro.

US initial jobless claims represent the number of people who claimed unemployment benefits for the first time during the previous week. This indicator measures the labour market climate, with an increase in initial jobless claims indicating rising unemployment. The previous reading was 221 thousand; the forecast for 13 March 2025 does not appear very optimistic for the US dollar, suggesting an increase to 226 thousand.

The PPI is an inflation indicator tracking the average price change for goods and services of domestic producers. It records price changes from the sellers’ perspective and covers three production sectors: manufacturing, commodities, and processing. The PPI is often regarded as a leading inflation gauge for consumers, as rising costs for production and services typically filter through to consumers.

The US PPI data is projected to decrease slightly from the previous period to 0.3%. Given today’s news, the EURUSD forecast for today suggests a correction before a decline.

EURUSD technical analysis

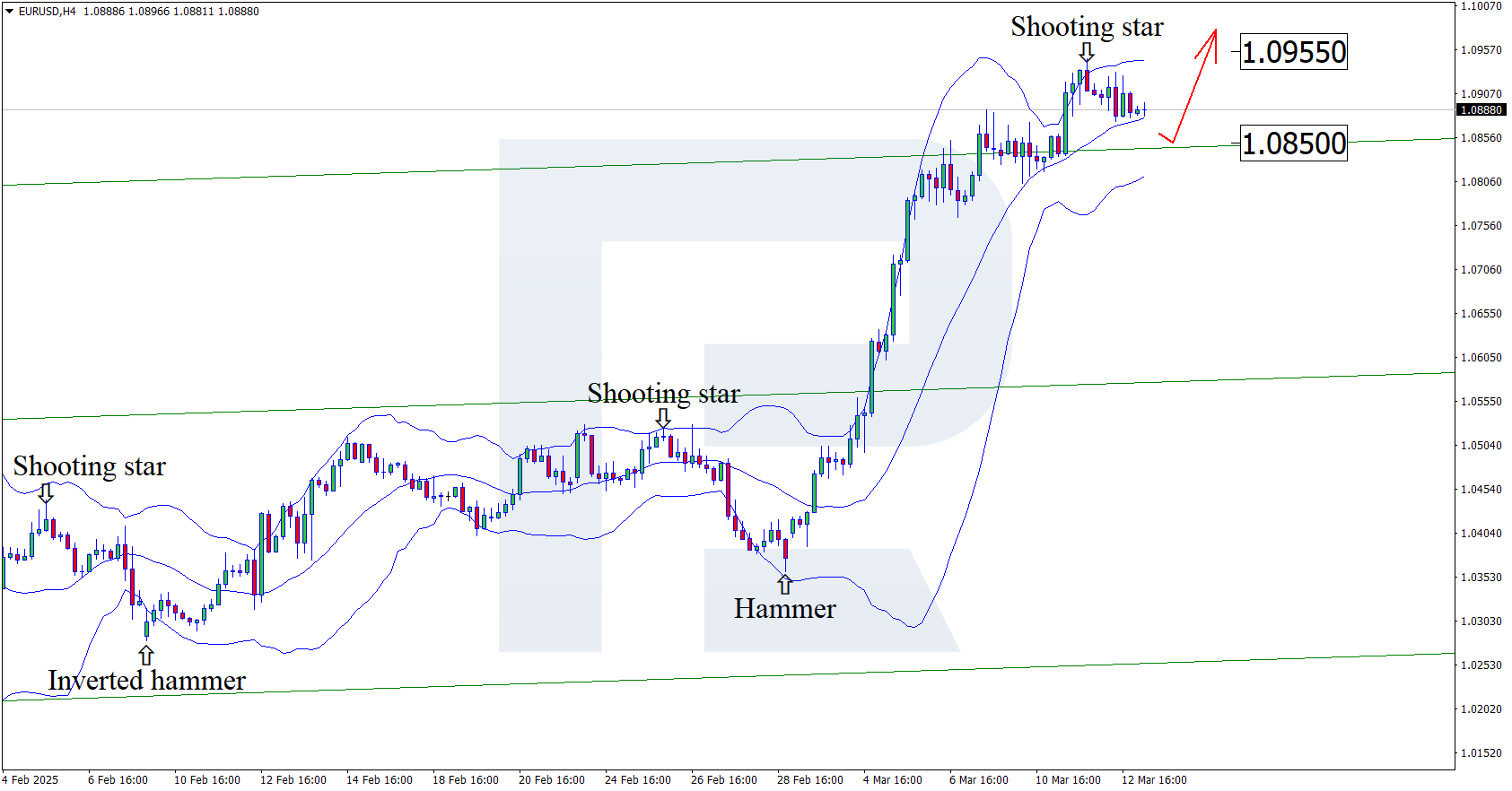

On the H4 chart, the EURUSD price formed a Shooting Star reversal pattern near the upper Bollinger band. At this stage, it continues another corrective wave following the signal received. Since the quotes have left the ascending channel, they could rise to the nearest resistance at 1.0955. A breakout above this level will open the potential for a continuation of the uptrend.

However, the EURUSD rate may drop to the 1.0850 support level and gain its upward momentum after the correction.

Summary

Amid industrial production growth in the eurozone and the decline in the US economic indicators, the EURUSD forecast for today appears rather optimistic. Coupled with the EURUSD technical analysis, it suggests growth to 1.0955 USD after a correction.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.