The British pound started a decline following sustained growth

The British pound started a decline following sustained growth

The Rightmove UK house price index for the last month was published on Monday, 17 June 2024. Although it was projected to come in at a positive value of 0.8, the index fell short of expectations, showing no growth and a value of precisely zero (0.0). This is not the most significant news at this stage, but the GBPUSD pair continues to lose ground as a result.

Federal Open Market Committee (FOMC) members Williams and Harker are scheduled to deliver their speeches at the beginning of the US trading session. These speeches have the potential to significantly influence the GBPUSD rate.

The speeches of the Federal Open Market Committee (FOMC) members may shed light on potential changes in the Federal Reserve’s monetary policy. The Committee members participate in voting on interest rate changes, develop monetary policy strategies, and assess risks related to achieving the regulator’s long-term targets, such as price stability and sustainable economic growth. In the negative aspect, the FOMC members’ speeches may significantly affect the price situation and cause the US dollar to lose its position. In this case, the British pound has every chance to continue its uptrend.

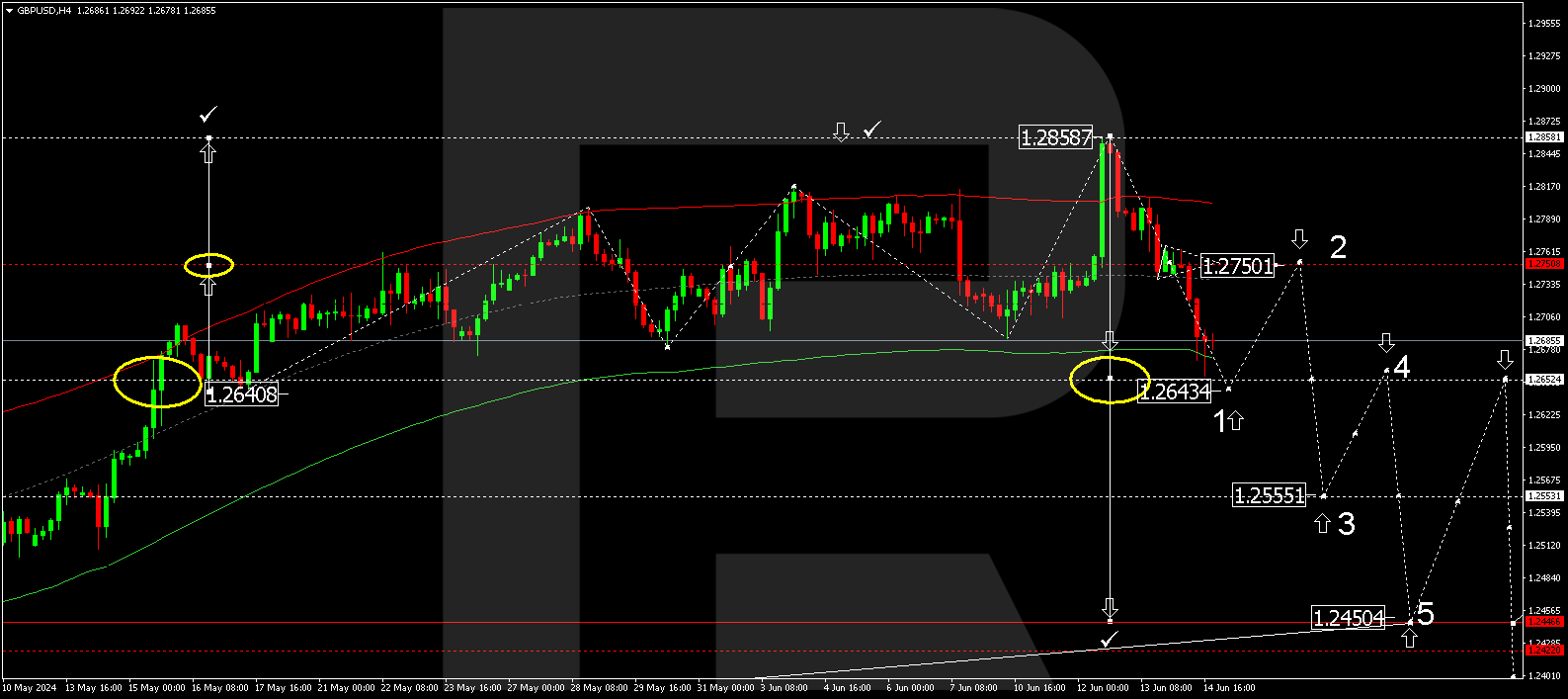

GBPUSD technical analysis

Based on the technical analysis for 17 June 2024, the GBPUSD rate is currently developing the first decline wave towards 1.2450. On the H4 chart, the first structure of this wave is taking shape, with a target at 1.2644. Once the price reaches this level, a consolidation range is expected to form above it. if there is an upward breakout, a correction could develop, aiming for 1.2750. After the correction is complete, a new decline structure in the GBPUSD rate might develop, with a 1.2655 target. A breakout of this level will open the potential for a decline wave towards the local target of 1.2555. If the price exits the consolidation range downwards, it will open the potential for a decline wave directed towards 1.2555. This scenario is technically confirmed by the Elliott Wave structure and a wave matrix with a pivot point at 1.2750. The market has completed a decline to the lower boundary of the Envelope, with a rise to its upper boundary being expected.

Summary

The FOMC members’ speeches may collectively help the GBPUSD rate form a corrective wave before continuing the uptrend. The GBPUSD technical analysis points to a decline wave, with the next targets at 1.2644, 1.2555 and 1.2450.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.