AUDUSD is falling for the fourth consecutive day: no one needs risk

The AUDUSD pair is under pressure, hovering at 0.6287. The market is cautious. Discover more in our analysis for 21 March 2025.

AUDUSD forecast: key trading points

- The AUDUSD pair falls lower as the market is generally cautious

- The lack of details about China’s stimulus package puts additional pressure on the AUD

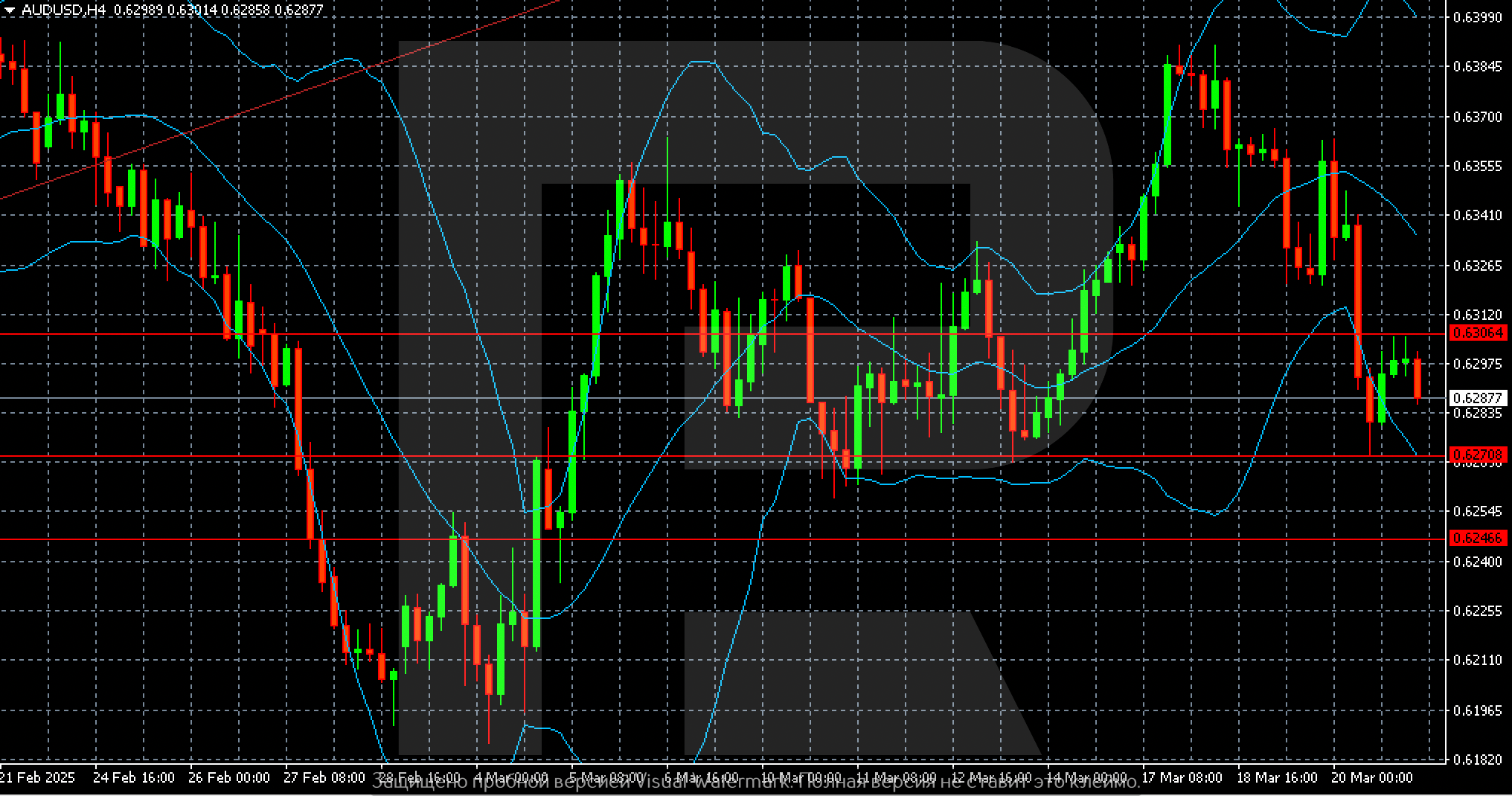

- AUDUSD forecast for 21 March 2025: 0.6270 and 0.6246

Fundamental analysis

The AUDUSD rate declined to 0.6287, with the Australian dollar tumbling for the fourth consecutive trading session. Caution and common sense prevail in the stock market, although global economic and trade concerns are only mounting.

The currency market is preparing for a significant date – 2 April, when US retaliatory measures against countries that have imposed tariffs on US goods will take effect. This increases the likelihood of a new round of trade wars. This prospect does not sit well with anyone.

The AUD is under additional pressure from the uncertainty about the size of China’s new stimulus package. Due to Australia’s traditional trade ties with China, this always impacts the Aussie’s trajectory.

Reserve Bank of Australia Assistance Governor Sarah Hunter stated this week that the February rate cut was aimed at easing tight policy. She also said that the RBA is more cautious about further rate cuts than markets expect.

Opinions are mixed on the next RBA rate cut, with some investors expecting such move as early as May and others anticipating it in July or August.

The AUDUSD forecast appears cautious.

AUDUSD technical analysis

On the AUDUSD H4 chart, the sentiment remains negative and does not rule out the extension of the selling wave towards 0.6270. A breakout below this level will open the way for a decline to 0.6246.

Summary

The AUDUSD pair is under pressure for the fourth consecutive day, and so far, it is only falling. This is due to the general market tension amid the likelihood of another escalation of global trade wars. The AUDUSD forecast for today, 21 March 2025, suggests that the downtrend could persist, with the first target at 0.6270.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.