Gold (XAUUSD) resumes growth: market fears US tariffs

Gold (XAUUSD) is hovering around 3,020 USD on Wednesday, with investors interested in safe-haven assets. Discover more in our analysis for 26 March 2025.

XAUUSD forecast: key trading points

- Gold (XAUUSD) continues to rise after a brief pause

- Markets still seek risk protection amid Trump’s tariff wars

- XAUUSD forecast for 26 March 2025: 3,036 and 3,057

Fundamental analysis

Gold (XAUUSD) prices strengthened to 3,020 USD.

The market is heading for record levels again as Gold's appeal as a safe-haven asset increases, fuelled by uncertainty over the upcoming US retaliatory tariffs.

While President Donald Trump’s tariff plans may be limited and targeted, investors are still pricing in considerable risk. The new round of tariffs set to begin on 2 April will signal an escalation in trade tensions between the US and its key partners.

At the same time, geopolitical developments also remain in focus, with the US playing a diplomatic role. This involves potential easing of sanctions against Russia. In the long run, this could reduce investor appetite for Gold.

The Gold (XAUUSD) forecast is positive.

XAUUSD technical analysis

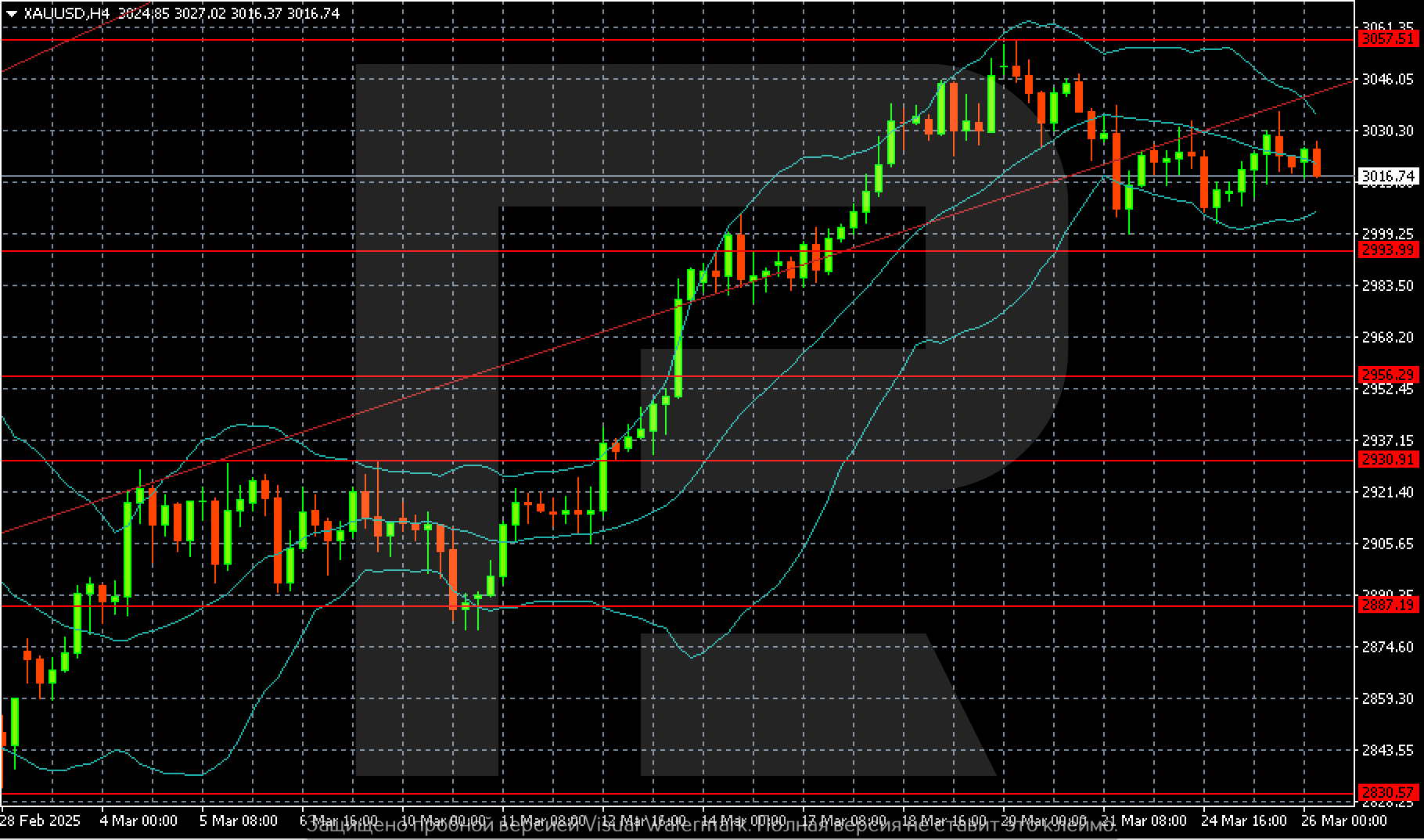

On the H4 chart, Gold (XAUUSD) prices remain trapped in a sideways range with boundaries at 2,993 and 3,057.

The intermediate resistance level lies at 3,036. A breakout above this level would open the way to the range’s upper boundary, with prices retesting the all-time high.

Summary

Gold (XAUUSD) prices resumed their upward movement. With uncertainty still surrounding Trump’s new tariff plan, the market continues to hedge against potential risks. The Gold (XAUUSD) forecast for today, 26 March 2025, suggests further growth with a target at 3,036.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.