Gold (XAUUSD) is in a consolidation phase but a new rise may be around the corner

Gold (XAUUSD) has stabilised around 2,910 USD. Demand for safe-haven assets will be an argument in favour of price growth. Find more details in our analysis for 10 March 2025.

XAUUSD forecast: key trading points

- Gold (XAUUSD) prices have risen and remain poised for further growth

- Demand for safe-haven assets and high economic risks due to Trump’s policies support Gold (XAUUSD)

- XAUUSD forecast for 10 March 2025: 2,930 and 2,956

Fundamental analysis

Gold (XAUUSD) prices are neutral around 2,910 USD at the beginning of the week.

The US dollar is in a weak position today, while demand for safe-haven assets is rather strong due to growing market concerns about Donald Trump’s tariff war. Although he suspended 25% tariffs on most goods from Canada and Mexico, Canadian retaliatory measures remain in place, with China’s countermeasures taking effect today.

Investors are additionally concerned about Trump’s statements in an interview with Fox News on Sunday. He evaded a question of whether the US economy is facing the threat of recession or rising inflation.

Meanwhile, Federal Reserve Chairman Jerome Powell said on Friday that Fed officials are in no rush to lower interest rates amid growing uncertainty about the US economic outlook. Investors now focus on the US inflation report due this week, which will provide better insight into the Federal Reserve’s future policy.

The Gold (XAUUSD) forecast is favourable.

XAUUSD technical analysis

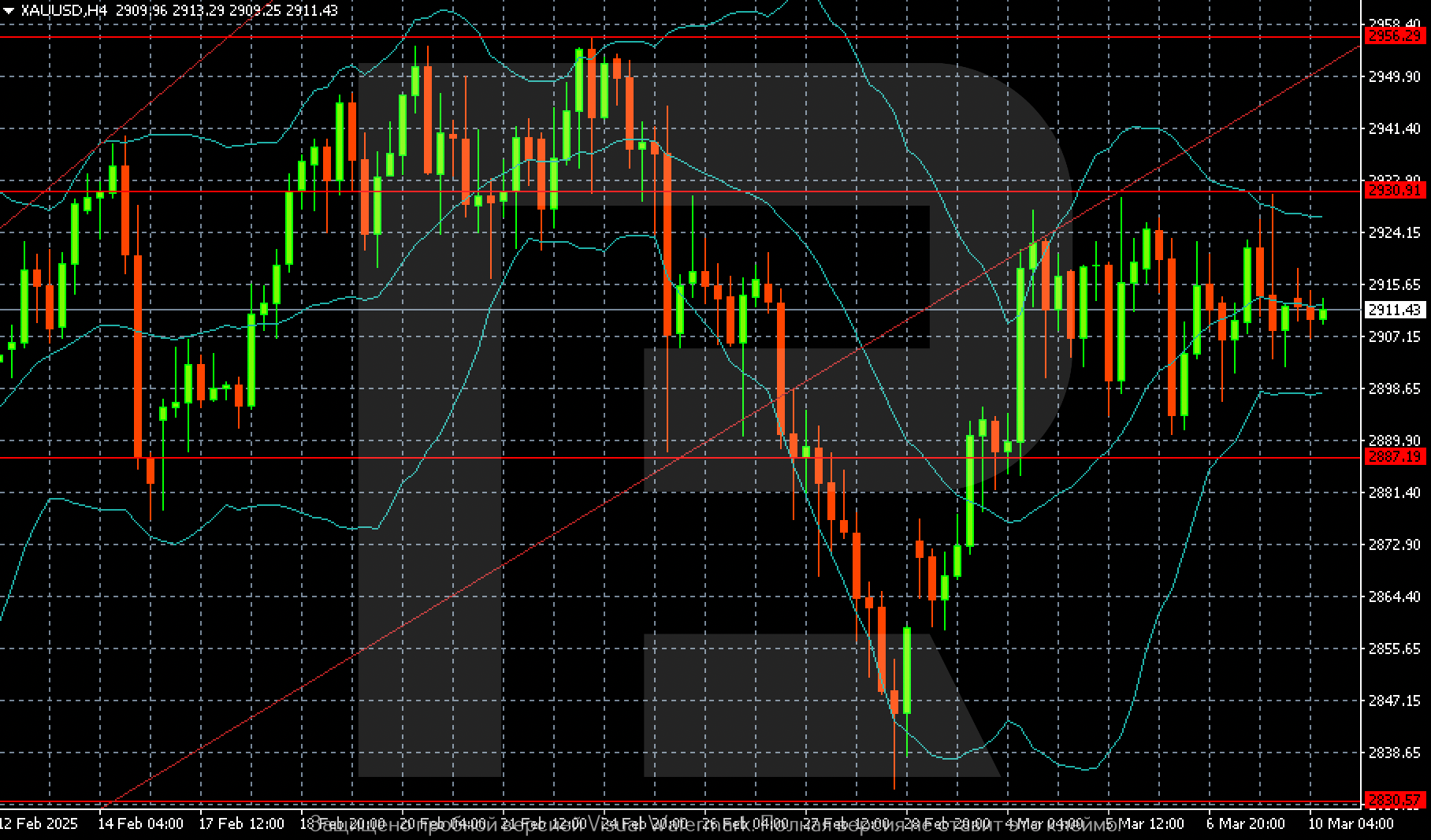

On the Gold (XAUUSD) H4 chart, the nearest upside target is still at 2,930, with the next one at 2,956.

Summary

Gold (XAUUSD) starts the week with consolidation, but the outlook remains favourable. Further growth is supported by strong demand for Gold as a safe-haven asset. The Gold (XAUUSD) forecast for today, 10 March 2025, expects the upward wave to extend, with the first target at 2,930.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.