Gold (XAUUSD) corrects before growth

Having completed the correction, XAUUSD quotes may continue their ascent towards 2,968 USD amid weak US economic indicators. Find more details in our XAUUSD analysis for today, 21 February 2025.

XAUUSD forecast: key trading points

- Manufacturing PMI: previously at 51.2, projected at 51.3

- US Michigan inflation expectations: previously at 4.3%, projected at 4.3%

- Current trend: moving upwards

- XAUUSD forecast for 21 February 2025: 2,968 and 2,910

Fundamental analysis

The XAUUSD analysis for today shows that XAUUSD prices are forming a correction towards 2,910 USD, with the pair likely to develop a new growth wave after a pullback.

The manufacturing PMI measures the activity of purchasing managers in the industrial sector. It reflects the state of the industrial sector and the dynamics of manufacturing processes in the country. Traders closely monitor changes in this index, as purchasing managers are the first to receive information about the performance of their companies, which makes PMI an important indicator for assessing the overall economic situation. Readings above 50.0 indicate an increase in production, while values below it point to a decline.

The forecast for 21 February 2025 shows that the US manufacturing PMI may rise to 51.3. Although growth is insignificant, it should be noted that the reading is above the 50.0 level.

The University of Michigan will release data on US inflation expectations at the beginning of the American trading session. The previous reading was 4.3%, and the forecast for 21 February 2025 suggests that inflation could remain unchanged. Despite the stabilisation of expected inflation, it may affect XAUUSD prices.

XAUUSD technical analysis

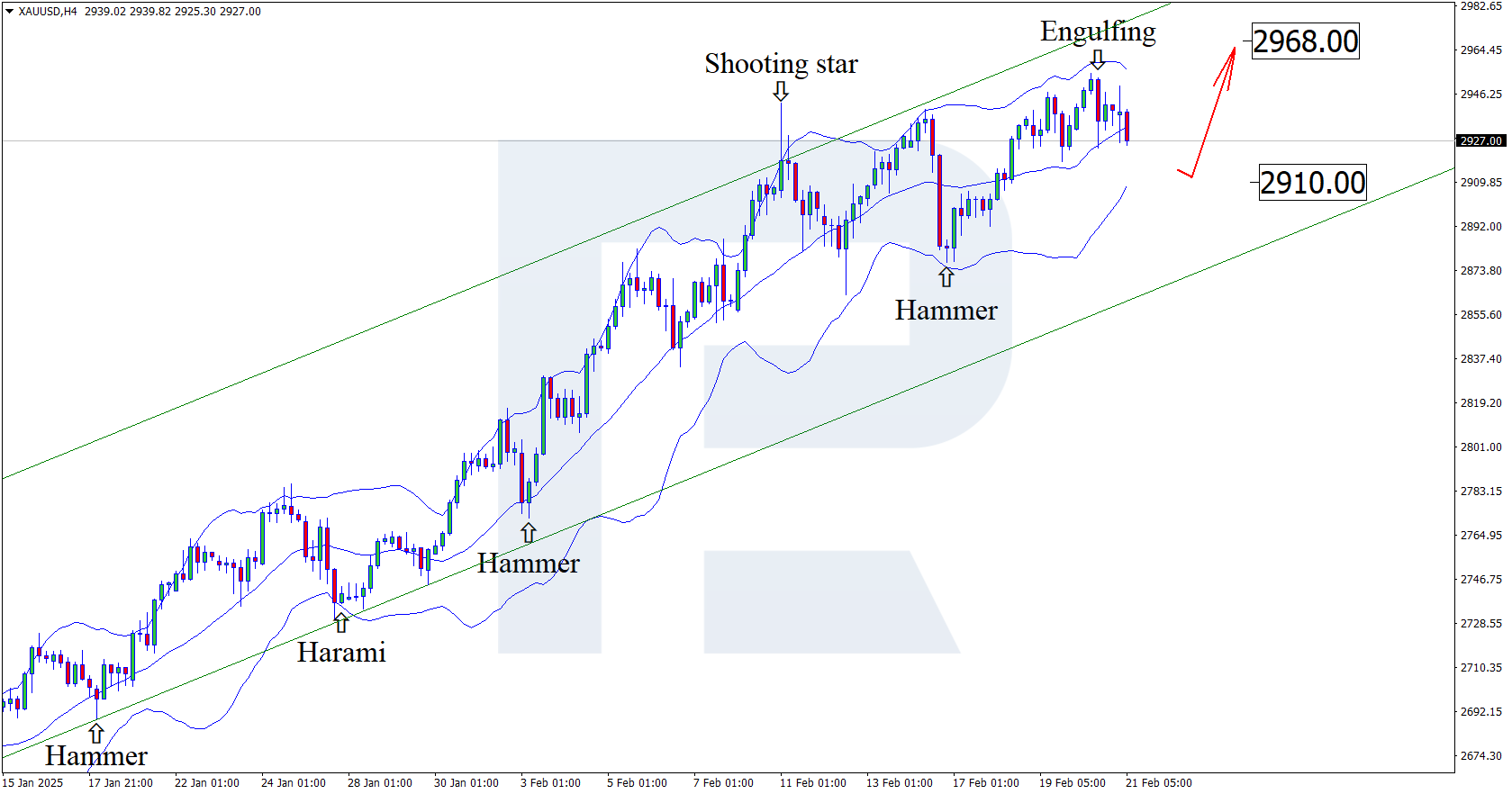

On the H4 chart, XAUUSD prices formed an Engulfing reversal pattern near the upper Bollinger band. At this stage, they continue to correct following the signal from the pattern. The uptrend will likely continue after a pullback as XAUUSD quotes remain within the ascending channel.

The target for the correction could be the 2,910 USD resistance level.

At the same time, the XAUUSD technical analysis for today suggests the second scenario, where prices rise to 2,968 USD.

After testing the resistance level, XAUUSD prices could reach an all-time high in the short term and head towards 3,000 USD.

Summary

The XAUUSD forecast for today, 21 February 2025, is supported by technical analysis, which suggests a correction towards the 2,968 level before growth. US inflation is above the Fed’s expectations, and a slight uptick in PMI may act as an additional trigger for USD weakness.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.