Gold (XAUUSD) continues to soar to new price highs

The increase in US nonfarm employment does not strengthen the US dollar significantly, with Gold prices continuing their ascent to 2,880 USD. Discover more in our XAUUSD analysis for today, 5 February 2025.

XAUUSD forecast: key trading points

- The US ADP nonfarm employment change: previously at 122 thousand, projected at 148 thousand

- The US services PMI: previously at 56.8, projected at 52.8

- Current trend: moving upwards

- XAUUSD forecast for 5 February 2025: 2,830 and 2,880

Fundamental analysis

The XAUUSD forecast for 5 February 2025 shows that XAUUSD prices have broken above the 2,850 USD level, with the pair likely to continue its upward momentum.

The US nonfarm employment change is a national employment report from ADP, which tracks changes in nonfarm jobs based on data from about 400 thousand business sources. The report is published two days before official US employment data. The reading is currently projected at 148 thousand. If the actual data aligns with expectations, the market may see increased volatility. Conversely, worse-than-forecast data may weaken the USD against Gold.

The US services PMI is expected to decline to 52.8. A stronger-than-expected PMI reading will provide some support to the US dollar.

The XAUUSD price forecast appears rather optimistic as the quotes have the potential to reach 2,880 USD.

XAUUSD technical analysis

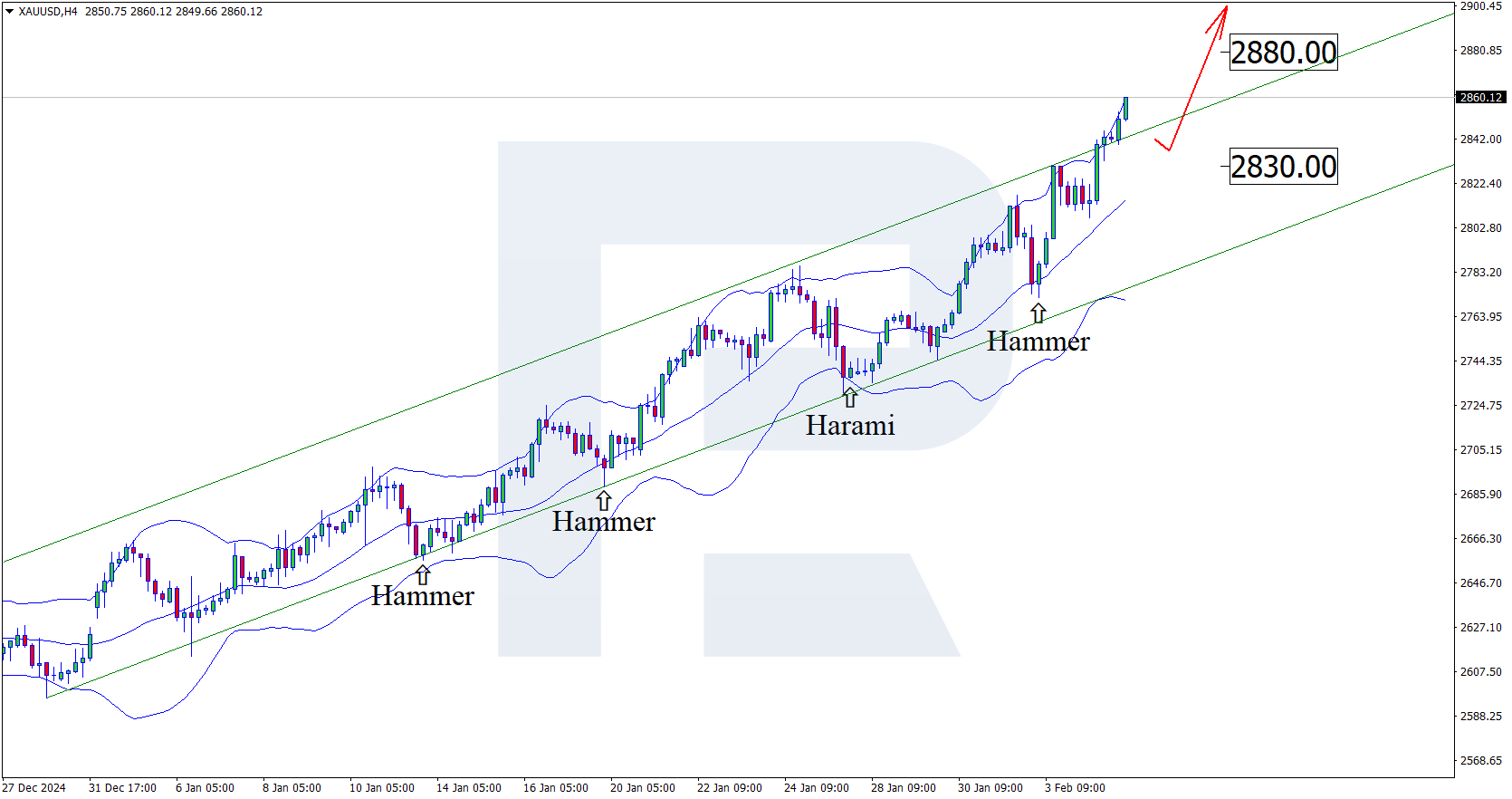

On the H4 chart, XAUUSD prices formed a Hammer reversal pattern near the middle Bollinger band after a pullback. At this stage, they continue their upward trajectory following the signal from the pattern. The uptrend will likely continue as XAUUSD quotes have left the ascending channel.

The upside target could be the next resistance level at 2,880 USD. A breakout above this level could pave the way for a more substantial upward movement.

However, the XAUUSD technical analysis for today suggests the second scenario, where prices correct towards 2,830 USD before continuing their ascent. Once the correction is complete, Gold could reach a new all-time high in the near term and head towards the 2,900 USD level.

Summary

The US news landscape does not help the US dollar strengthen against Gold. Technical analysis suggests further growth in XAUUSD prices towards 2,880 USD.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.