Market is in suspense: where will Brent head after the API report?

In anticipation of the API report, Brent prices are rising and could reach the 72.25 USD level. Discover more in our analysis for 18 March 2025.

Brent forecast: key trading points

- Brent crude oil prices are on the rise

- Weekly US crude oil inventories from the American Petroleum Institute (API): previously at 4.247 million barrels

- Brent forecast for 18 March 2025: 70.00 and 72.25

Fundamental analysis

Fundamental Brent analysis for today, 18 March 2025, takes into account that oil prices continue their upward momentum.

Today, 18 March 2025, Brent prices are slightly rising amid geopolitical tensions in the Middle East and China’s stimulus measures. Brent futures were up 17 cents (0.2%), reaching 71.24 USD per barrel. The US Department of Energy revised its previous forecast, expecting Brent prices to average at 74.22 USD per barrel in 2025.

Despite the current price increase, long-term forecasts take into account a possible decline in Brent prices due to global economic factors.

According to the API, weekly US crude oil inventories rose significantly in the previous reporting period. The Brent analysis for today takes into account that following the data release, the quotes could maintain their upward trajectory and head towards 72.25 USD.

Brent technical analysis

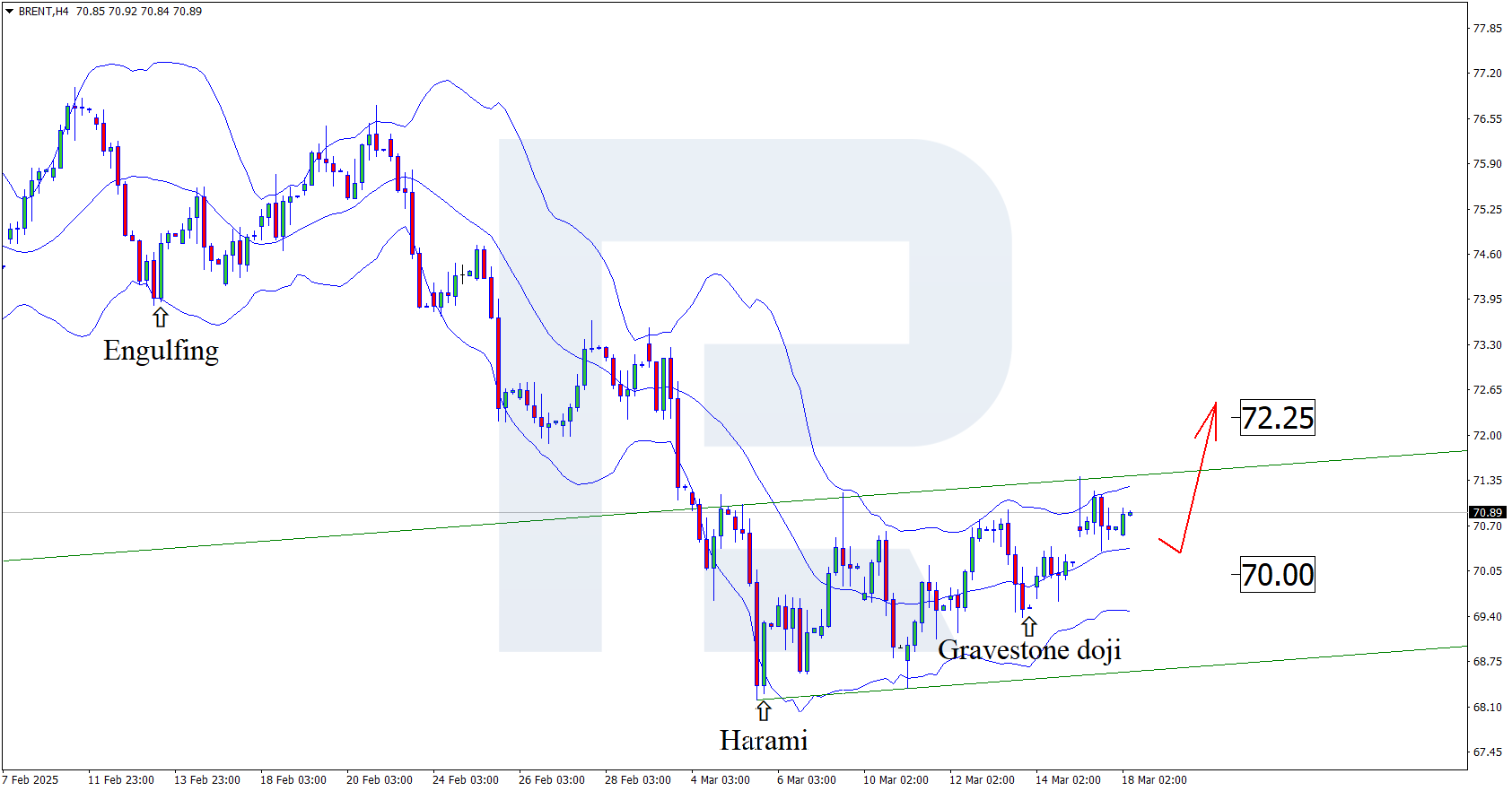

Having tested the lower Bollinger band, Brent prices formed a Gravestone Doji reversal pattern on the H4 chart. At this stage, they continue their upward movement following the pattern signal. Since the quotes are moving within an ascending channel, they could rise to the resistance level.

The Brent forecast for 18 March 2025 suggests that an upside target could be the next resistance level at 72.25 USD. A breakout above this level could pave the way for a more substantial upward movement.

However, an alternative scenario is possible, where Brent quotes may plunge to the 70.00 support level before growth.

Summary

Along with today’s Brent technical analysis, the global geopolitical environment and China’s stimulus measures suggest that Brent prices could rise further to 72.25 USD.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.