Brent tumbles amid increased oil output

Brent quotes are declining for the third consecutive trading session, with the price currently at 70.85 USD. Find out more in our analysis for 4 March 2025.

Brent forecast: key trading points

- OPEC+ decided to gradually increase oil output

- US President Donald Trump announced an increase in tariffs on Chinese imports

- Escalating trade wars could reduce oil demand

- Brent forecast for 4 March 2025: 68.65

Fundamental analysis

Brent quotes are falling on Tuesday after OPEC+ decided to gradually increase oil production. The alliance members, which have previously voluntarily cut output, will start to gradually increase it from April. The decision made on 3 March provides for incremental growth in oil production until September 2026.

The market is also under pressure from escalating trade wars. Donald Trump announced an increase in tariffs on Chinese imports from 10% to 20%. Additionally, 25% duties on imports from Canada and Mexico will take effect on Tuesday. The possible reaction of these countries will only exacerbate the conflict, negatively affecting the global economic outlook and oil demand.

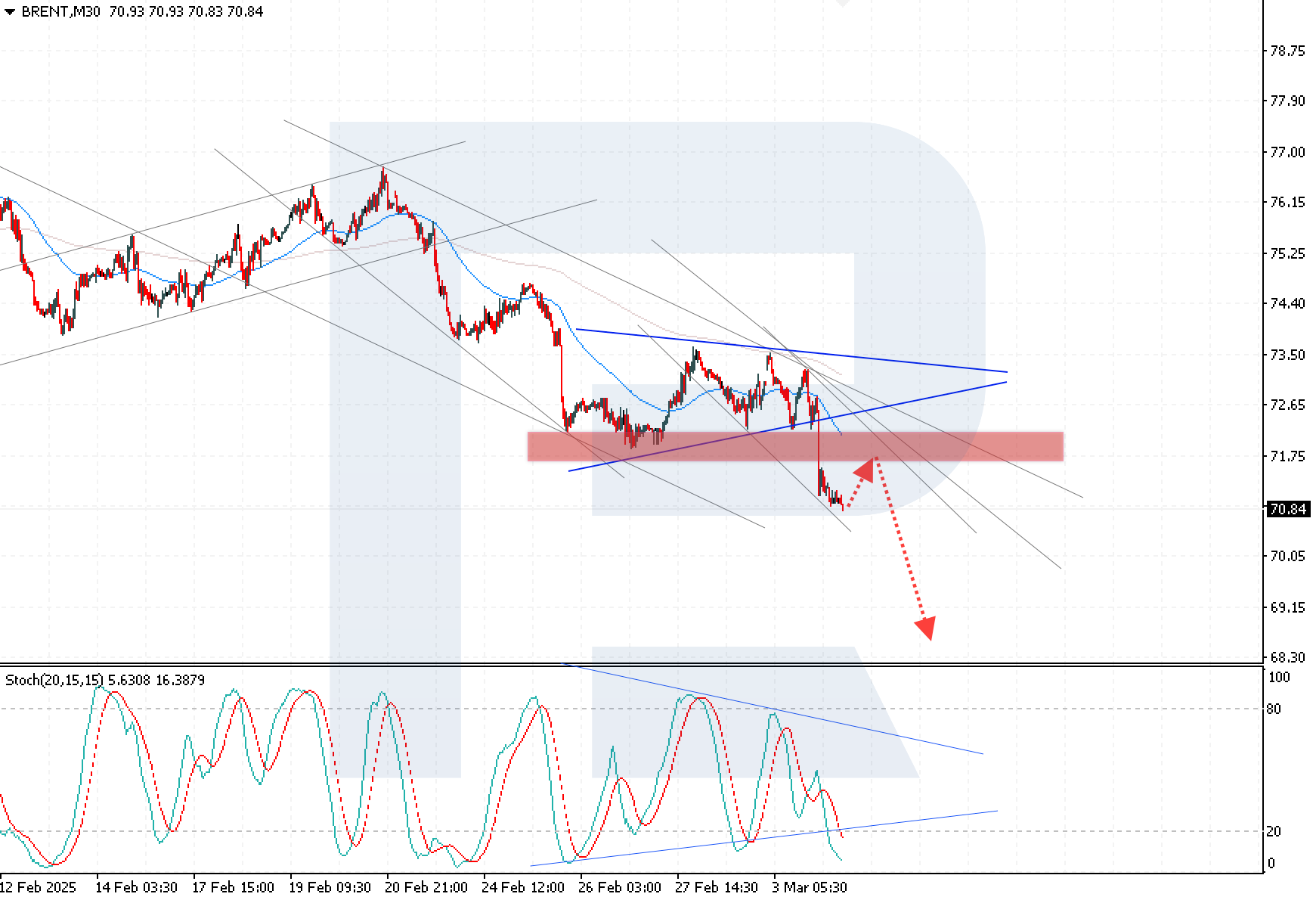

Brent technical analysis

Brent prices are declining after breaking below the lower boundary of the Triangle pattern. Sellers gained a foothold below the key support level at 71.70 USD, indicating a strong downward momentum. According to the Brent forecast, prices are expected to fall to the next support level at 70.10 USD, a breakout below which will open the way to 68.65 USD. Technical indicators confirm the bearish trend, with the Moving Averages signalling the predominance of sellers and the Stochastic Oscillator indicating the imminent formation of a sell signal.

Summary

The decline in Brent quotes is driven by the OPEC+ decision to increase oil production and the escalation of trade wars by Donald Trump, which may adversely affect oil demand. The Brent analysis for today suggests that the downtrend will persist, and a breakout below the 70.10 USD level could accelerate the fall to the target of 68.65 USD.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.