Brent attempts to rise: oil benefits from lower supply

Brent prices rose to 76.25 USD. The news flow is attracting attention. Find out more in our analysis for 11 February 2025.

Brent forecast: key trading points

- Brent prices continue their ascent

- The market reacts to reduced energy supplies but closely monitors risks from the US

- Brent forecast for 11 February 2025: 76.10 and 77.03

Fundamental analysis

Brent prices climbed to 76.25 USD per barrel on Tuesday, up 1.6% from the previous trading day. The market is responding to signals about a reduction in crude exports from Russia and a potential expansion of supply risks in general.

Oil production in Russia fell short of the OPEC+ quota in January. The market is also following the news about new US sanctions against individuals and tankers involved in the transportation of Iranian oil to China to put pressure on Tehran.

At the same time, stock market caution curbs growth in oil prices. Investors are sensibly assessing the risks of trade tensions and wider economic uncertainty.

The Brent forecast is moderately positive.

Brent technical analysis

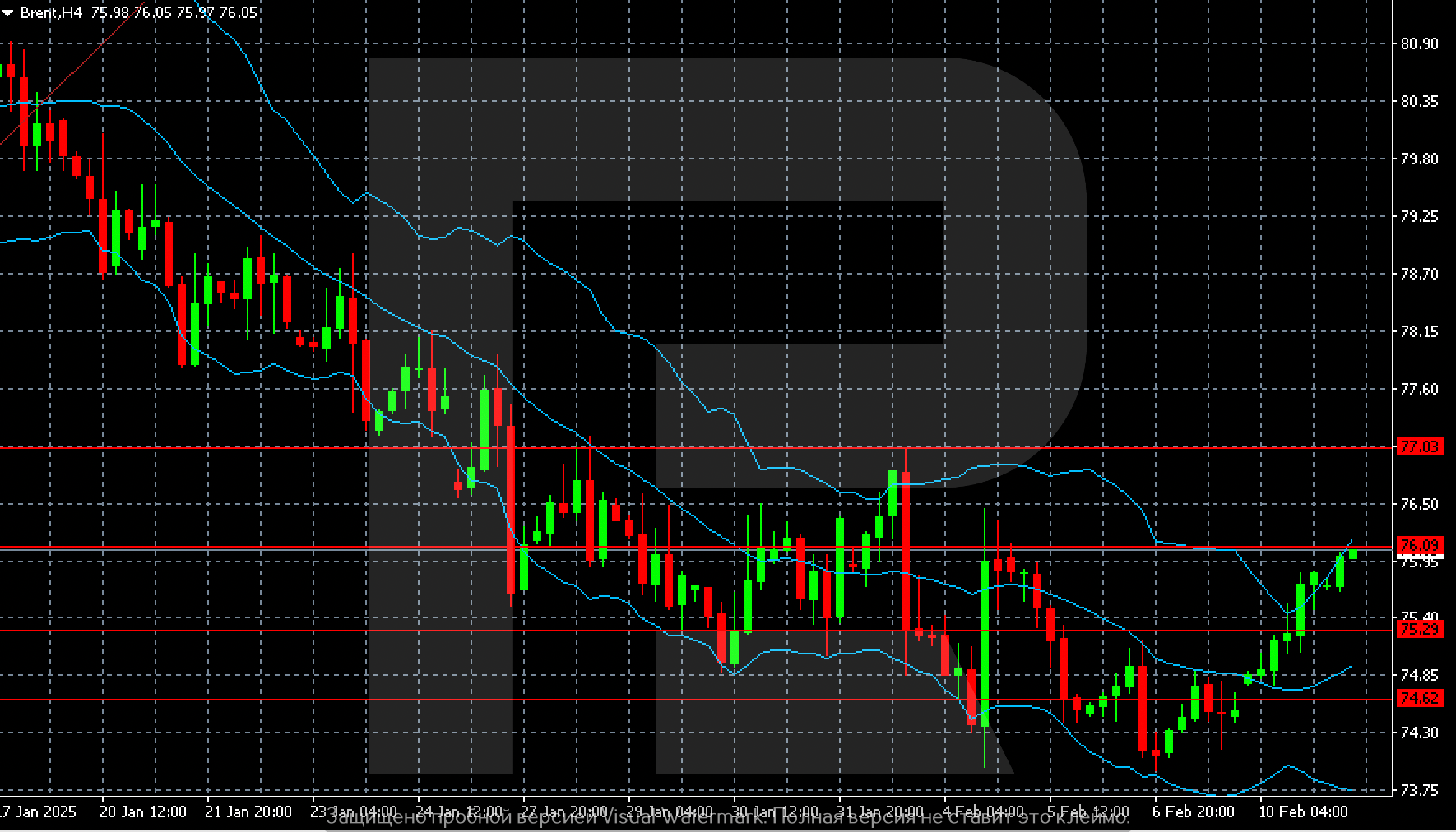

The Brent H4 chart shows a scenario, where prices could climb to 77.03. This will become possible if the market consolidates above 76.10.

If corrective trends are stronger, significant support levels are at 75.29 and 74.62 USD.

Summary

Brent prices maintain their upward momentum on Tuesday after rising by 1.6% on Monday. The Brent forecast for today, 11 February 2025, suggests that the current buying wave could extend up to 77.03 USD.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.